Australia's New South Wales (NSW) state government will require coal producers to reserve up to 10pc of their output for domestic use, including export-focused firms that have largely been unaffected by the domestic coal price cap.

The NSW government amended legislation in December to allow it to cap domestic coal prices at A$125/t, and to control who it could be sold to. This initially affected mining firms like Thai-owned Centennial Coal that have contracts to supply NSW power plants, but the plan for a 10pc coal reservation policy will impact exporters and could remove coal from the seaborne market.

Australian independent coal exporter Whitehaven Coal, which was not subject to the initial price cap and orders imposed on domestic coal suppliers, has been briefed on the expansion of the policy to new participants, including Whitehaven. The other major thermal coal exporters from the state are Yancoal, BHP, Glencore, Idemitsu, Mach Energy, New Hope and Peabody.

BHP stopped domestic sales of thermal coal in 2019 after a contract expired, allowing it to redirect around 500,000 t/yr of coal to export markets. Glencore could already be meeting its requirements under the cap, having produced 27.6mn t for export over January-June 2022 and 3mn t for the domestic market. Chinese-owned Yancoal is focused on exports and the NSW coal reservation policy would coincide with a reopening of China to imports of Australian coal, potentially creating problems for the firm.

NSW produces around 200mn t/yr of saleable coal and exports around 175mn t/yr. But three years of above-average rainfall has seen production and exports fall, with the key port of Newcastle shipping 136mn t of coal in 2022 compared with 156.33mn t in 2021 and a peak of 165.14mn t in 2019.

Exporters had hoped to increase exports in 2023, but the NSW reservation policy will add to a raft of headwinds to this ambition.

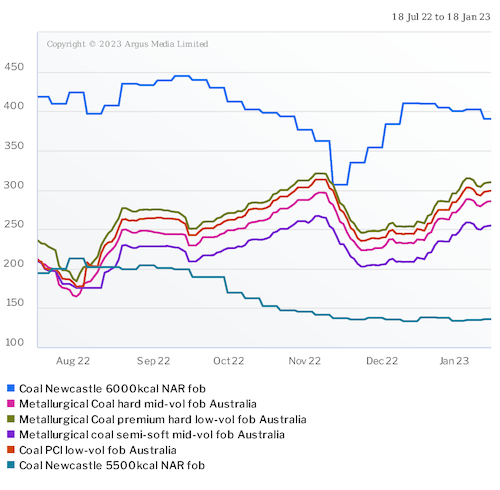

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $390.15/t fob Newcastle on 13 January, down from $410.17/t on 9 December and from a peak of $444.59/t fob on 9 September last year. It assessed lower-grade 5,500 kcal/kg NAR coal at $135.69/t fob Newcastle on 13 January, down from $200.81/t on 2 September and from a peak of $287.15/t on 11 March last year. The heat-adjusted premium for higher-grade thermal coal on a NAR 6,000 kcal/kg basis was $242.12/t on 13 January, down from a peak of $264.65/t on 9 December but up from $177.93/t on 1 July 2022.

Australian coal price comparisons $/t