Pump jacks at an oilfield in Texas. Oil futures gained despite a surprise rise in US crude stocks.

Oil prices rose on Thursday after surging by about 3 per cent in the previous session amid increasing hopes of a rebound in fuel demand in China.

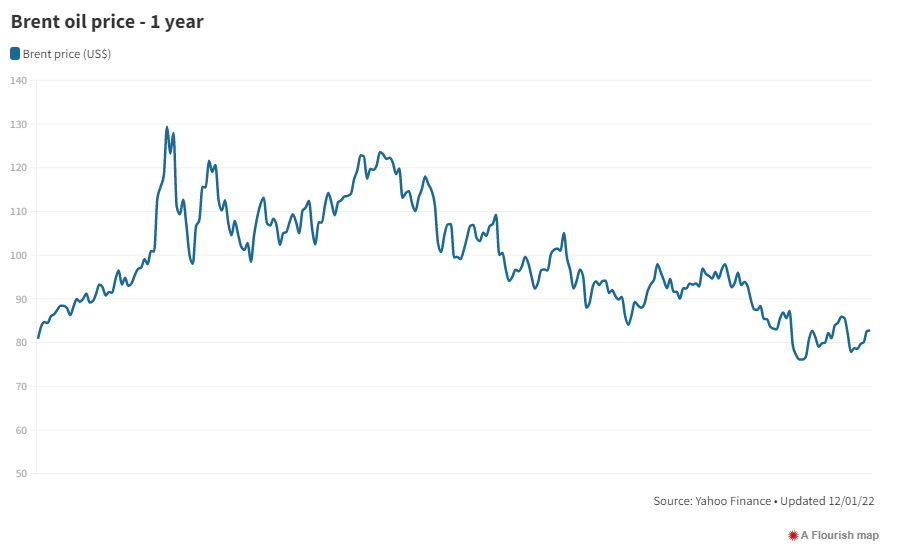

Brent, the benchmark for two thirds of the world’s oil, was 1.31 per cent higher at $83.75 a barrel at 4.17pm UAE time while West Texas Intermediate, the gauge that tracks US crude, was up 1.23 per cent at $78.36 a barrel.

Brent closed 3.2 per cent higher at $82.67 on Wednesday while WTI was up 3 per cent at $77.41 at the end of the session.

“Oil demand is coming back and expectations are high that China’s demand is about to skyrocket,” said Edward Moya, a senior market analyst at Oanda.

China’s near-total reversal of border controls — introduced to stem the spread of Covid-19 — came into effect on Sunday.

The reopening ended about three years of strict entry requirements that had slowed growth in the world’s second-largest economy and biggest crude oil importer.

Jeff Currie, global head of commodities at Goldman Sachs, expects Brent to reach $110 a barrel by the third quarter if China and other Asian economies fully reopen.

Futures gained despite a surprise rise in US crude stocks.

US commercial crude oil stocks increased by 19 million barrels last week, the biggest rise since February 2021, according to the US Energy Information Administration.

The EIA expects global consumption of liquid fuels such as petrol, diesel and jet fuel to set a record in 2024.

Global liquid fuel consumption will exceed 100 million barrels per day, on average, in 2023 for the first time since 2019, then average more than 102 million bpd in 2024, the EIA said in its short-term energy outlook on Tuesday.

Amrita Sen, founder and director of research at Energy Aspects, expects Brent to average $100 a barrel this year, driven by a recovery in China.

“China's reopening is going to be the number one thing driving oil prices this year,” Ms Sen told attendees at the Gulf Intelligence Global UAE Energy Forum on Wednesday.

“The upside could be quite substantial, just depending on the timing of it. China is still grappling with a lot of Covid cases, which has meant that oil demand is yet to pick up quite substantially.

“But, we are starting to see some of the green shoots with regards to demand and the jet numbers are picking up [and so is] gasoline [demand].”

Japanese bank MUFG projects that Brent will hit $110 by mid year 2023 and average $101 a barrel this year and the supply-side will "begin to bite" in the second half of the year.

"Its been a painful start to the year for crude oil with financial markets still pricing in recession, despite the physical market pricing in supply scarcity," said Ehsan Khoman, head of research – commodities, ESG and emerging markets, MUFG.

"China reopenings, the recovery in aviation, an acceleration in Russian oil decoupling, the slowdown in US shale, tightness in the diesel market, the end of US SPR releases, sill low levels of capex investment, all play a role in this. Critically, with little buffer in the system, we expect demand to hit a price-inelastic supply curve again."

Hopes of softer interest rate increases by the US Federal Reserve have also supported prices, after Brent fell by more than 8 per cent last week, its biggest weekly loss in the first seven days of a new year since 2016.

Last month, the Fed raised its interest rates by 50 basis points to curb inflation, which hit a four-decade high in June 2022, and indicated that more increases are planned this year.

The Fed raised interest rates seven times in 2022.

A weaker dollar, which makes oil cheaper for holders of other currencies, also buoyed futures.

The US Dollar Index, a measure of the value of the greenback against a weighted basket of major currencies, was down 0.12 per cent at 103.07 on Thursday morning. The index is lower by 1.4 per cent since January 1.