Taiwan's energy transition roadmap, for which "core strategic plans' were unveiled this week, is still light on details about LNG's specific future.

However, Taiwanese officials tell Energy Intelligence that the world's sixth largest LNG importer will continue to lean heavily on LNG for several decades. This is thanks in part to the lack of a Taiwanese nuclear revival, and despite a costly effort to boost renewable energy and hydrogen.

Core Strategic Plans

Taiwan's National Development Council (NDC) unveiled this week a set of 12 “core strategic plans” to promote the country's transition to net-zero carbon emissions by 2050 together with a revised carbon reduction commitment and ambitious goals for renewable energy and hydrogen use.

The 12 plans flesh out a roadmap issued by the Cabinet-level council on March 30, in line with Democratic Progressive Party (DPP) President Tsai Ing-wen`s declaration in April 2021 that Taiwan will aim for net-carbon neutrality by 2050

According to the NDC plans, nearly NT$900 billion (US$29.3 billion) will be invested in "250 net-zero" projects between now and 2030, including NT$211 billion in renewable energy and hydrogen and NT$207.8 billion in power grid and storage.

Environmental Protection Administration (EPA) Minister Chang Tzu-ying added that Taiwan will revise its nationally determined contribution from a carbon emissions reduction of 20% by 2030 from the 2005 level of 280 million tons to "24% plus or minus 1%."

But Taiwan isn't jumping onto the nuclear revival bandwagon in contrast to fellow Asian economic power Japan, which also released a draft of its "Green Transformation" plan this week.

The DPP government is keeping to its schedule for the retirement of the last nuclear reactor — in May 2025 — and will be relying on LNG paired up with renewables through at least 2040 while bringing up hydrogen, other renewables (geothermal, biomass, wave/current) and later converting LNG hardware for use with hydrogen.

The Role of LNG

The NDC plans presented this week did not include specific targets for LNG or coal. Back in 2017, the government set energy transition targets of 50% of total power generation in 2025 for LNG, 30% for coal and 20% for renewables.

Deputy Economics Minister Vincent Tseng Wen-sheng told Energy Intelligence that the share of total power generation for LNG in 2030 was likely to remain close to that of 2025, or about 50%, but the shares of coal and renewables would switch places. Going from about 30% for coal and just less than 20% for renewables, to 30% renewables and 20% coal.

By 2050, LNG and "carbon capture, utilization and storage" will account for between 20%-27% of power generation, compared to 60%-70% (between 91 gigawats-151 GW) for renewables and 9%-12% from hydrogen and 1% from pumped storage.

Tseng said that CPC Taiwan and Taipower are "rushing to complete" several LNG projects, including the third receiving terminal at Guantang, Taoyuan City and LNG generators in the Taichung, Tunghsiao and Hsingta power plants.

Taiwan Environment and Planning Association Chairman Chao Chia-wei told Energy Intelligence that “a shortcoming in the planning framework is the lack of a clear linkage for the transition from LNG to hydrogen.”

However, Chao said the announcement by NDC Chairman Kung Ming-hsin this week that future economic development or construction projects would be required to have “zero carbon transition” assessments “is an important step.”

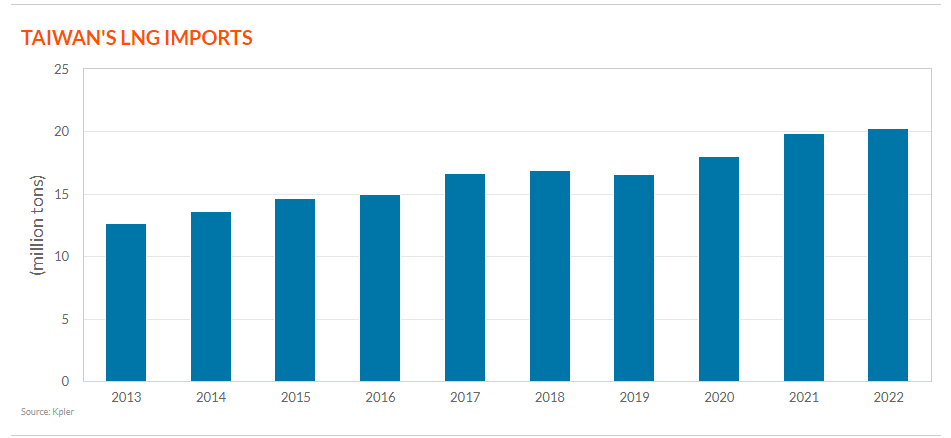

Taiwan has been the sixth largest LNG importer in 2022 with 20.3 million tons imported. The country was ranked 5th for many years, trailing Japan, China, South Korea and India, but was surpassed this year by Spain amid the war-induced European energy crisis.

Hydrogen, Wind and Solar

A specific strategic plan for hydrogen highlighted plans for its use as a fuel for power generation, industry and transportation as well as construction of a hydrogen supply chain and infrastructure.

According to the road map, Taiwan will expand its use of hydrogen from 0.57 megawatts in 2022 to 91 MW by 2025 through trial demonstration projects and mixed fuel burning projects. It will expand its use to 891 MW by 2030 with trial operation of a hydrogen co-firing power demonstration plant with fuel mixture of 5%. During 2023-24, the central government will budget NT$4.62 billion for hydrogen development plans.

In the longer-term from 2031-50, the NDC plan anticipates large scale introduction of hydrogen into power generation through co-firing with LNG or exclusive use to hike its share of total power generation to 9%-12% by 2050 as well as expanding use in steel production and other industrial processes. The plan is to reach a combined contribution of 7.3 GW-9.5 GW.

The plan for wind and solar energy retains the goals of 5.6 GW for offshore wind power and 20 GW of solar power for 2025 and has set new goals for 2030 of 13.1 GW for offshore wind and 31 GW for solar. By 2050, the NDC aims to install 40 GW-55 GW in offshore wind power and between 40 GW-80 GW in solar power.