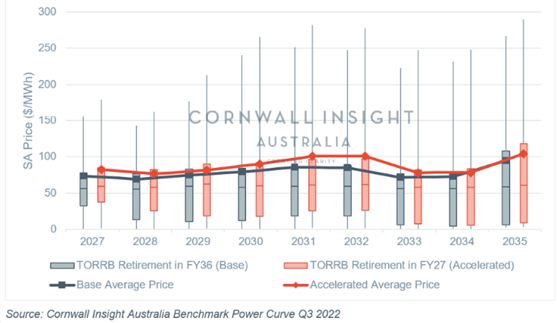

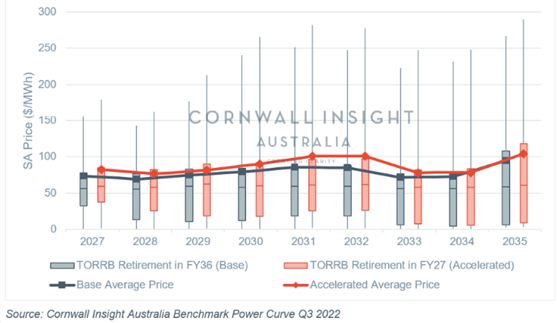

Research from Cornwall Insight Australia has revealed that the accelerated closure of Torrens Island B gas-fired power station could raise the annual average electricity market price by as much as 19% from 2027 to 2035 and increase market price volatility in South Australia (SA) if a replacement plant is not established.

Last month AGL announced that it would be moving up Torrens Island B’s retirement date from 2035 to 2026. The decision to close early was, it said, partly down to the expected influx of a significant amount of renewable energy resources from building the EnergyConnect interconnector, which will impact the economic viability of the fossil fuel plant.1

The data, modelled using Cornwall Insight Australia’s Benchmark Power Curve, indicates that if there is no replacement plant, the accelerated closure will see around an 8% to 19% (12% on average) uplift in average prices from 2027 to 2035.

As part of Australia’s energy transition, investments are being made to ensure sufficient network capacity to host renewable energy generation, share the renewables between regions, and maintain power system security and reliability. One of the interconnectors being built is EnergyConnect, which will provide 800MW of transfer capacity between South Australia and New South Wales. Despite all the benefits this new interconnector introduces, the impact on fossil fuel providers will be extensive.

Based on the average projected dispatch profile of Torrens Island B at 20% capacity factor, a rough estimate of the capacity replacement would be around 600MW of wind and 300MW of 4-hour batteries to cover both the peak and off-peak periods.

Figure 1: Comparison of market price volatility in South Australia from 27 TO 35 due to the accelerated retirement of Torrens Island B gas power station in 2026.

Dominic Pacaba, Energy Modelling and Analytics Consultant, at Cornwall Insight Australia said:

“Like much of the world, Australia is going through an incredible energy transition, one many would say is long overdue. The significant investment in renewables is slowly coming to fruition as interconnectors start to be built across Australia. The additional network capacity will bring with it many benefits; however, the inevitable casualty will be the economic viability of fossil fuel plants.

“While reducing our reliance on higher-cost gas plants should only be taken as a positive, the reality is that the increase in our capacity to transfer renewables across the network may not enough to compensate for the level of loss we will see as plants such as Torrens Island B close their doors. Investment in additional renewable energy and storage capacity will be essential to compensate for the early closure of these plants.

“Torrens Island B is not likely to be the last generator to announce an earlier closure of its facilities. With more interconnectors coming in and more aggressive state renewable energy targets, the industry should prepare for the energy transition sooner rather than later.”

Reference:

One of the four units at Torrens Island B was mothballed in 2021, and the remaining three units were initially scheduled for retirement in 2035. With the plant operating at around 20% capacity before the interconnector Project EnergyConnect (PEC) becomes operational, AGL brought forward the closure date to 2026, which coincides with the expected commercial operation date of PEC.

The Benchmark Power Curve sensitivity has been run on the assumption that there will be no new capacity to replace the outgoing Torrens Island B despite PEC being present in both scenarios.