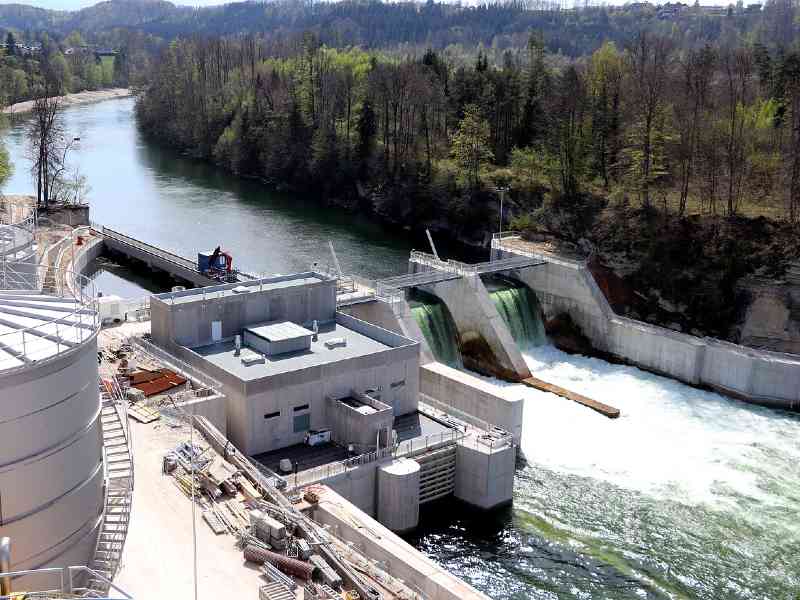

Image credit: WFranz on Pixabay

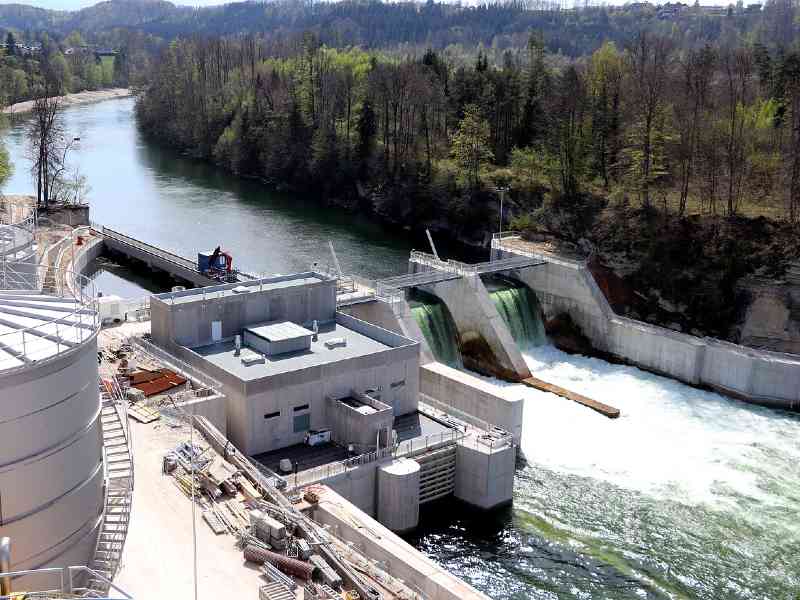

Image credit: WFranz on Pixabay

EDP Brazil said it believes in a future with more solar energy in its portfolio, in addition to more investments in distribution and transmission.

To this end, the company will invest BRL$6 billion (US$1.2 billion) in Brazil by 2025 with a goal to have 50% of its energy generated by solar.

According to BNamericas, the company has 85% of its generation coming from hydroelectricity but wants to reduce this percentage to half, with the other 50% coming from solar. The goal is to have 1GW of installed solar capacity by 2025 (today, this number is close to 0.1GW). For reference, Brazil had 9GW of installed photovoltaic capacity in 2021.

“We don’t want to be in all business verticals. We want to be in a few and with weight in them,” said João Marques da Cruz, chief executive officer of EDP. The two verticals listed by the executive are the dedicated distributed generation model and shared remote plants.

In the distributed generation model, a small plant is created on demand to serve a single client. The company has clients in this category, within the telecommunications and financial sector segments. Shared remote plants are dedicated to small businesses (pharmacies, restaurants, stores), which do not have enough demand to require an entire plant. For each megawatt of energy produced, about 100 customers of this size can be served, according to the company. On average, each plant targeted by EDP has 3MW to 4MW, which gives a total of 300 customers per plant.

The company said it is looking for land in the northeast and southeast to invest in distributed generation.

To focus its investments on photovoltaic energy, EDP plans some divestments. Hydroelectric generation is one of them, mainly because of the high exposure to rainfall in the country. In the third quarter, the company reported the sale of the 198MW Mascarenhas plant in Espírito Santo, which should be concluded by the end of the year, according to the CEO.

For now, the other two hydroelectric plants (Santo Antônio do Jari and Cachoeira Caldeirão) are not for sale because they have not reached a value that would please both parties, the executive said in a conference call with analysts.

EDP also plans to stop investing in thermoelectric generation. The company has a coal-fired plant in Porto Peçanha, in which it should cease to be the main shareholder as of 2025.

Regarding investments in transmission and distribution, this is an area the company only entered two years ago. The company said it will go to the auctions being held soon. Last year, it won the lot for construction in Acre and the privatization of CELG-T in Goiás. In addition to the December auction, the company is analyzing a possible presence in the June 2023 auction.

In the BRL$6 billion budget planned for the next five years, EDP Brazil will also invest in distribution.

With all the investments made, the company projects to increase its EBITDA by 10% to 15% annually until 2025. This is in real terms, in addition to inflation. In the past two years, EDP’s EBITDA has grown 88%.