Hydrogen made from the electrolysis of renewable electricity can be produced in almost every country, different to oil and gas production which is concentrated only around a few markets. Nevertheless, land availability constraints or a high domestic cost of the renewable electricity could lead to energy imports becoming attractive.

For imports to be cost effective the production cost differential between countries needs to be larger than the transport cost. Looking at the coming decades, transport costs are expected to decrease in a 1.5°C scenario as export-import facilities are scaled up, technologies improve, and global supply chains are put in place. At the same time, production cost will decrease as global renewable capacity increases. This recent IRENA report explores alternative scenarios on how these parameters could evolve towards 2050 and their effect on global hydrogen and ammonia trade.

What are the trade drivers?

Hydrogen has a low energy density which makes necessary some processing before transporting it. Common options are liquid hydrogen, ammonia, and liquid organic hydrogen carriers (these are oil-like molecules that react reversibly with hydrogen) for shipping and gaseous hydrogen pipelines.

Transport costs could reach levels below USD 1/kgH2 (for 20,000 km) once supply chains are fully developed. The largest lever to achieve this is economies of scale where projects would need to reach a scale of at least 0.4 MtH2/yr. This is equivalent to the production from a 4-GW electrolyser (with a 60% capacity factor) or three commercial ammonia plants.

On the other hand, most countries could produce hydrogen below USD 1.5/kgH2 by 2050 but specific countries like Germany, India, Italy, Japan, and Republic of Korea have limitations on the share of land that is available for renewable energy, making imports more attractive.

Hydrogen trade outlook by 2050

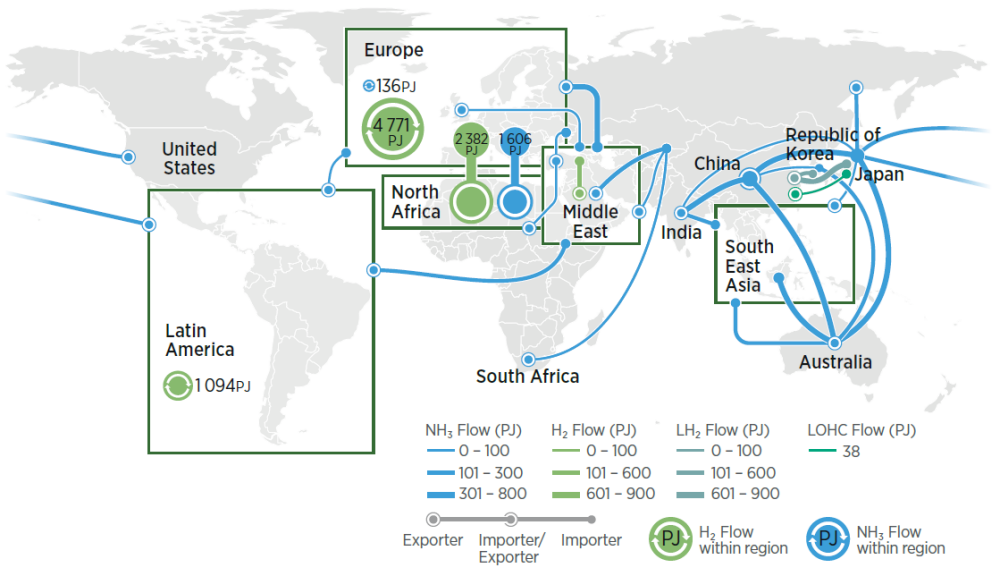

Figure 1 shows the most optimistic 2050 scenario where production and transport costs have come down to less than USD 1/kgH2 each. Global hydrogen trade reaches 18.4 EJ/yr in 2050, which is about a quarter of the total hydrogen demand in 2050. This share is comparable to global gas trade in 2020 (about 33%) and much lower than oil (74%).

The hydrogen trade is roughly equally split between hydrogen pipelines and ammonia ships. Hydrogen pipelines are largely concentrated in two areas: Europe (85% of the global trade by pipeline) and Latin America (remaining 15%). Europe has natural gas pipelines that could potentially be repurposed to hydrogen leading to a 65-94% cost reduction in the capital cost of the pipeline and making transport much cheaper than other options. A risk that could limit this option is the potential hydrogen leakage that needs to be further assessed.

Over 70% of the ammonia globally traded is directly used instead of being reconverted to hydrogen. Ammonia cracking back to hydrogen can consume the equivalent of about a third of the energy contained in the molecule. At the same time, the ammonia market is expected to almost quadruple towards 2050 in a 1.5°C scenario driven by its use as fuel for international shipping.

This scale of trade would need an investment of at least USD 4 trillion to deploy 10.3 TW of renewable capacity (vs 3.1 TW of total capacity in 2021), 4.4 TW of electrolysis (vs 0.7 GW in 2021) and 1.6 TWh of batteries (vs 19.3 GWh in 2020).

Figure 1. Global hydrogen trade flows for an optimistic (low cost) set of technology assumptions in 2050 / Note: Optimistic capital expenditure assumptions for 2050: Photovoltaic (PV): USD 225-455/kW; onshore wind: USD 700-1 070/kW; offshore wind: USD 1 275-1 745/kW; electrolyser: USD 130/kW. Weighted average cost of capital: Per 2020 values without technology risks across regions. Green hydrogen technical potential is based on assessing land availability for solar PV and wind. Demand is in line with a 1.5°C scenario from the World energy transitions outlook (IRENA, 2022a). LOHC = liquid organic hydrogen carrier.

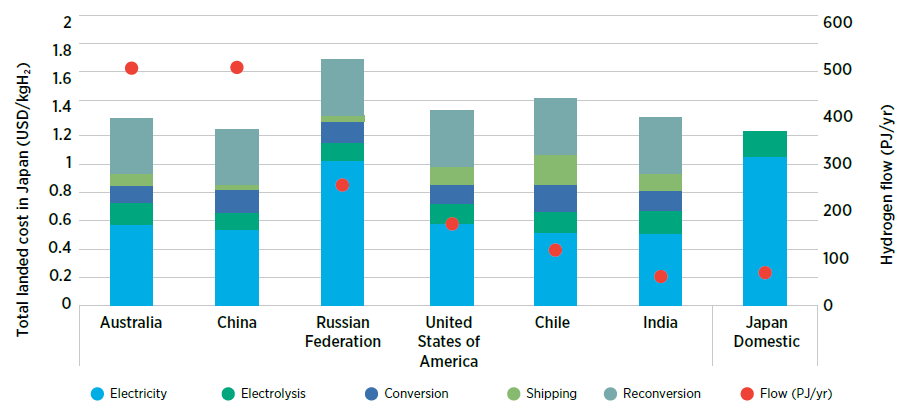

Costs of switching suppliers

In a future where costs across the value chain have come down, the cost penalty for switching suppliers is relatively small. Figure 2 shows the hydrogen supply mix for Japan and it shows how there are multiple trading partners within a narrow cost range. For this scenario and Japan, the cost penalty for switching from China (the lowest landed cost) to the next best option (Australia) is only about 6%. Thus, it would be a similar cost for trading with countries that have entirely different geopolitical conditions. This is also the case for the Republic of Korea and European countries that are among the ones with the most constrained renewable potential.

Figure . Landed cost breakdown for exporters to Japan in an optimistic (low) cost scenario in 2050 / Note: Flow refers to the energy flow from each exporter and shows the supply mix (including domestic production).

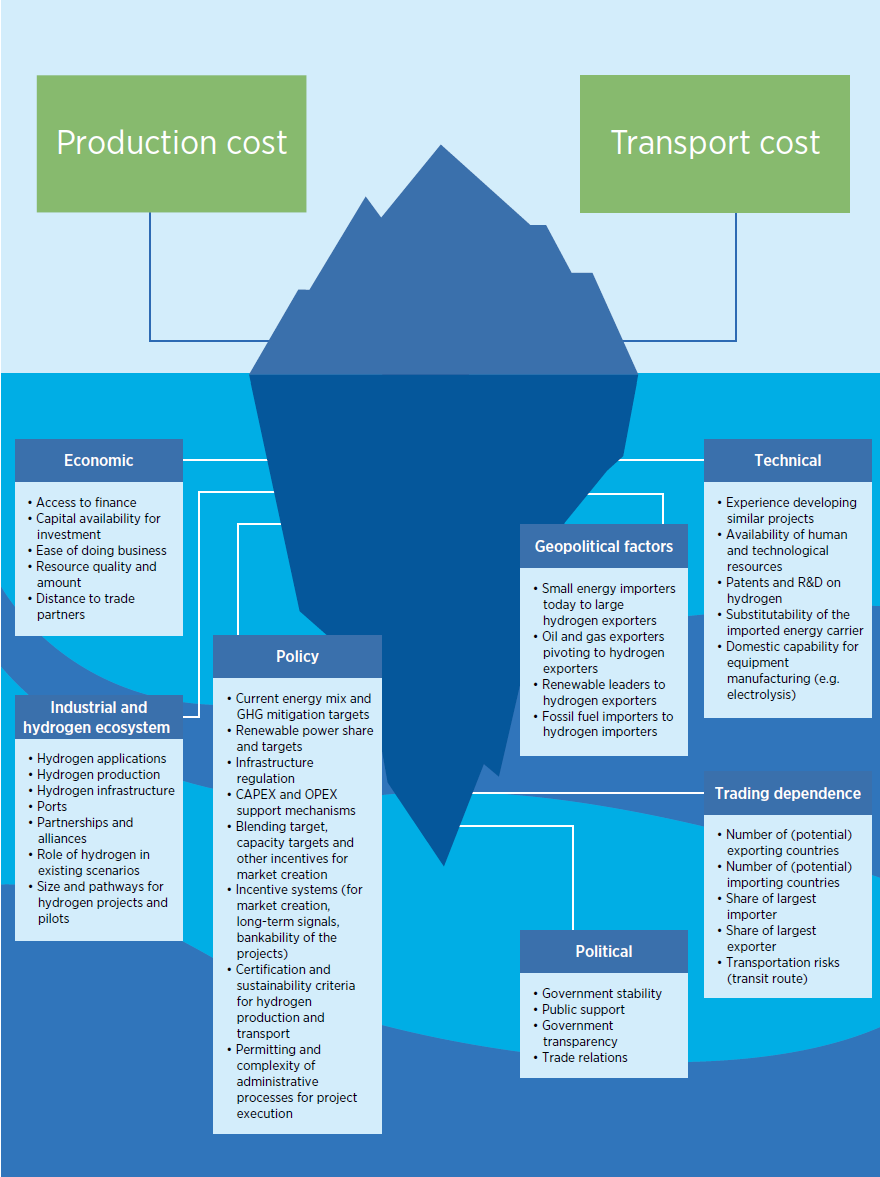

Understanding the factors beyond costs

Since renewable resources are more widespread than fossil fuels and technology development can allow reaching similar cost levels across multiple countries, hydrogen trade relationships will most likely be defined by factors beyond costs including policy support, geopolitical, industrial development, among others (see Figure 3).

These factors increase the complexity of determining the optimal supply mix for a country since it mixes quantitative aspects (costs) with qualitative aspects, and it could be done by following a two-step approach. First, determining the lowest cost suppliers by only looking at production and transport. Second, a multi-criteria decision analysis making the trade-off between cost and other factors.

Figure . Overview of factors for identifying potential trading partners of hydrogen and its derivatives.

There’s plenty still to do

Global hydrogen trade today is far from reality. Infrastructure needs to be constructed building upon the existing ammonia ports and storage and natural gas pipelines. Regulation including the operation of this new infrastructure needs to be put in place. Cost recovery models, financing and capital mobilisation to build this infrastructure is also needed. A marketplace needs to be created to bring supply and demand together and have a reliable and transparent price index that drives investment. Certification schemes are needed to be able to trace the greenhouse gas emissions across the entire value chain, relate hydrogen production to policy incentives, and these need to be compatible across borders to allow for the transfer of emissions along with the commodity.

Specific policy incentives are needed to close the cost gap in the early stages of deployment. Hydrogen deployment to reach 12% of final energy demand relies on a massive expansion of renewable capacity. Renewables deployment needs to expand almost fourfold compared to the current annual pace which will only make the task more challenging and why hydrogen must only be used for sectors that are difficult to electrify.