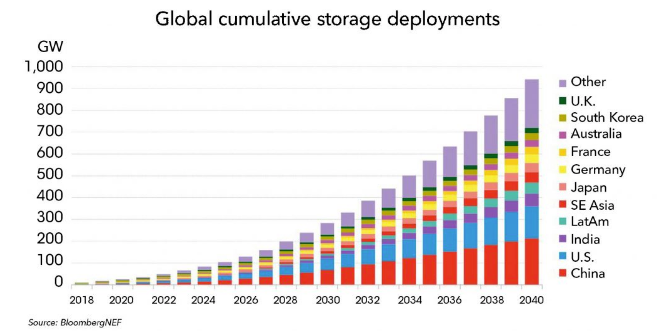

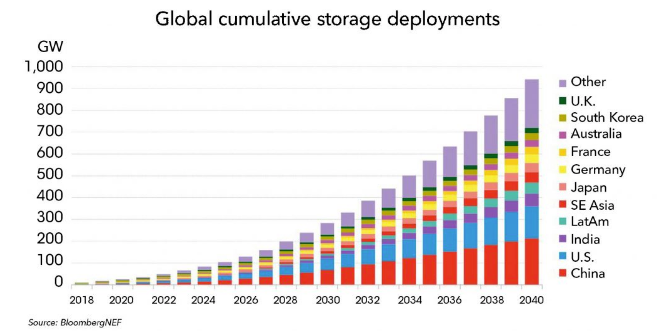

In 30 years since commercialisation, lithium-ion (li-ion) batteries have been used in an increasingly diverse range of products, starting from early generation handheld electronics to powering cars and buses. Additionally, these batteries are increasingly sought after for utilisation in energy storage applications, often paired with renewable energy generation. The continued decline in battery prices combined with the global trend toward energy grids being powered by renewable energy sources is predicted to increase the world’s cumulative energy storage capacity to 2,857GWh by 2040, a substantial increase from the current capacity of ~545MWh, according to recent estimates by Bloomberg New Energy Finance.

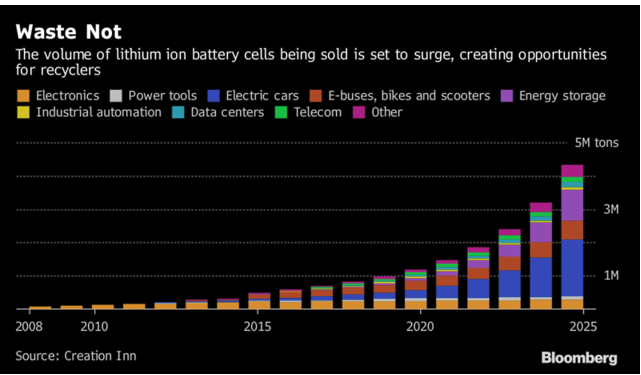

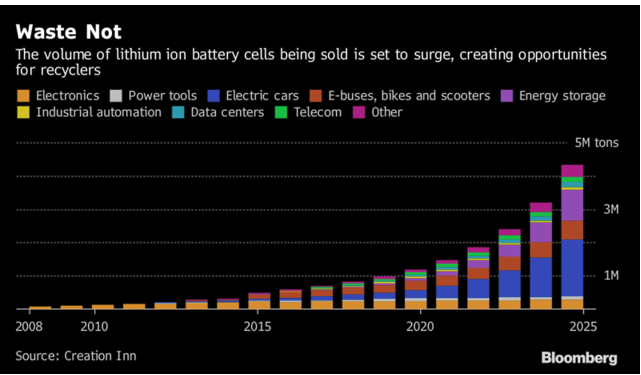

These staggering projections paint an encouraging picture for how prominent li-ion-driven energy storage applications will become in the future as the world increases usage of renewable, clean energy sources to power energy grids worldwide. Driven increasingly by electro-mobility as well as grid-scale energy storage applications, the volume of li-ion battery cells being sold is set to surge. The graph in Figure 2 contextualises the relative volume (in tonnes) of new li-ion battery cells forecasted to be sold through to 2025. The growing quantities of li-ion batteries being placed on the markets accelerates the urgency with which the world must find an economically viable, commercial-scale recycling solution for end-of-lifecycle li-ion batteries to be recycled at a ‘mega’ scale. This article will take a closer look at some of the challenges that exist today within the li-ion recycling sector and where opportunities exist to overcome the current roadblocks.

Li-ion recycling industry challenges

Secondary resource recovery (i.e. recycling) has a set of unique operational challenges that need to be addressed concurrent to the development of an economic, advanced technology. For the purpose of recycling, feed materials are typically inherently distributed, making it difficult to collect a high volume of feed for a processing plant. Although the collection supply chains for some analogous industries such as lead-acid battery recycling are well-established and mature by comparison, the li-ion battery recycling supply chain continues to be fluid. Spent li-ion battery sources can be broadly segmented into portable/’small format’ and ‘large format’ sources, which corresponds to the relative voltage of li-ion batteries (i.e. low voltage and intermediate to high voltage, respectively). Each of these types of batteries has a diverse group of stakeholders – from manufacturers, to the dealer network, recycling programmes, electronics and vehicle recyclers. In the context of the energy storage sector, its own diverse group of stakeholders exists – battery technology provider, energy storage integrator, project developer and asset owner. Managing the inherently heterogenous nature of li-ion batteries from a wide range of stakeholders remains a central challenge for companies in the li-ion resource recovery industry.

Logistics and regulations

Li-ion batteries are currently classified as Class 9 Dangerous Goods due their dual chemical and electrical hazard. Li-ion batteries can possibly undergo thermal runaway, typically resulting from internal shorting, leading to fire or explosion. There are numerous factors that can cause thermal runaway, including but not limited to overcharging, environmental conditions (e.g. extreme external temperatures) and manufacturing defects. At the onset of thermal runaway, the battery heats in seconds from room temperature to above 700°C. As part of this complex set of chemical reactions, the electrolyte solvent in lithium-ion batteries – typically alkyl carbonate-based – acts as a ‘fuel’ source for combustion.

Added care must also be taken when handling critical or damaged/defective batteries as there is an increased risk of thermal runaway. Specialised systems (e.g. Genius Technology’s LionGuard container for intermediate to high voltage lithium-ion batteries [4]) are typically used in tandem with non-flammable packing material to safely transport these batteries. As the overall volume of li-ion batteries increases, the quantity of critical or damaged/defective batteries is expected to increase across a broad swath of applications. As the li-ion battery resource recovery industry is still maturing, regulations vary significantly around the world. These regulations can also change significantly from year to year, as new industry and research reports are released. As a result, it is important to keep close track of regulatory (including logistics) considerations concurrent to process development.

Safety and storage

The challenges of logistics and changing regulations typically revolve around one key factor – safety. Safety is paramount for those who handle, transport, store and process li-ion batteries, as there is a risk of thermal runaway. This raises another unique challenge for processors and consolidators, relative to the primary production of commodities and specialties. Specifically, the safest approach is to have the lowest amount of spent li-ion batteries on site as possible, in order to mitigate the risk of a thermal runaway event occurring. However, this is contradictory to the requirement to secure significant amounts of feed for processing purposes. The development of safe storage is further complicated by the currently prominent format factor of spent li-ion batteries, i.e. portable/small format batteries (e.g. from mobile phones, laptops and other consumer products). Portable li-ion batteries are typically consolidated in drums and could be mixed with other battery types. Upon an initial inspection, the state of all collected batteries within a single drum is not always clear (i.e. whether undamaged or damaged) and often only becomes apparent when the drums are tipped for sorting or processing. As a result, strict protocols must be implemented regarding the pallet/container spacing, total storage density and application of appropriate fire suppression systems within any li-ion battery storage space in order to mitigate the risk associated with thermal runaway and fire.

Secondary resource processing challenge

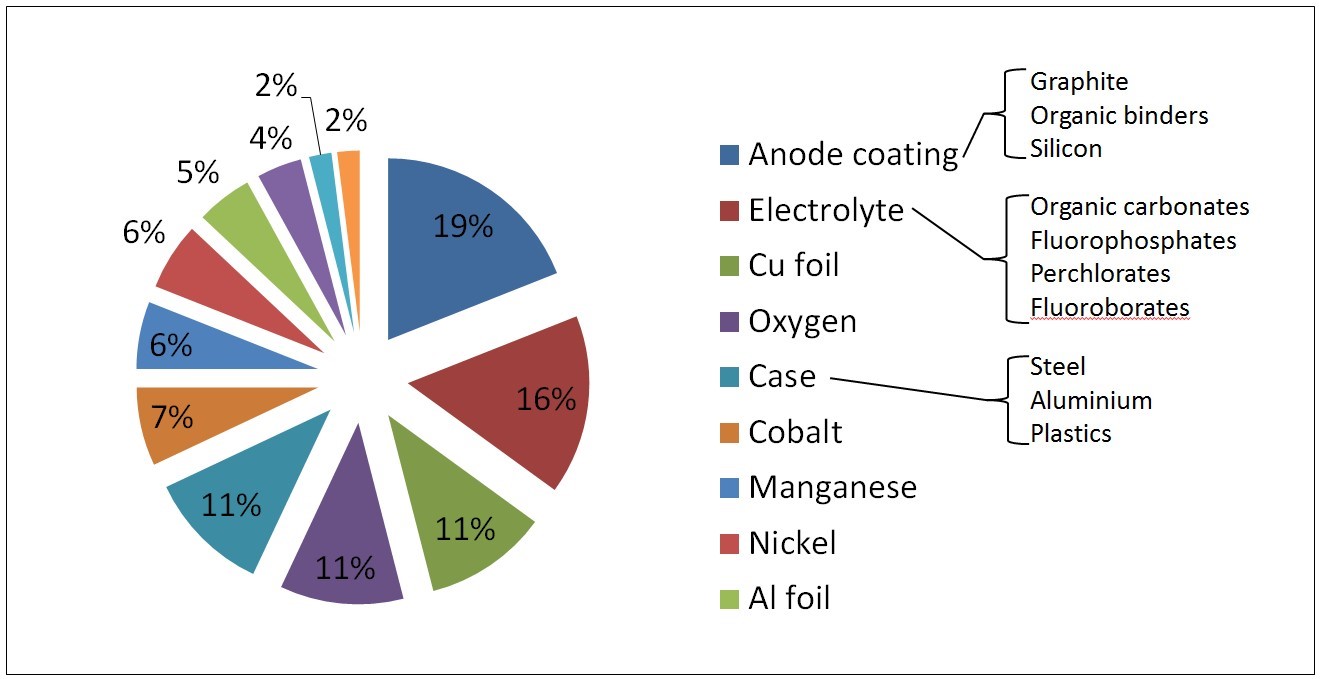

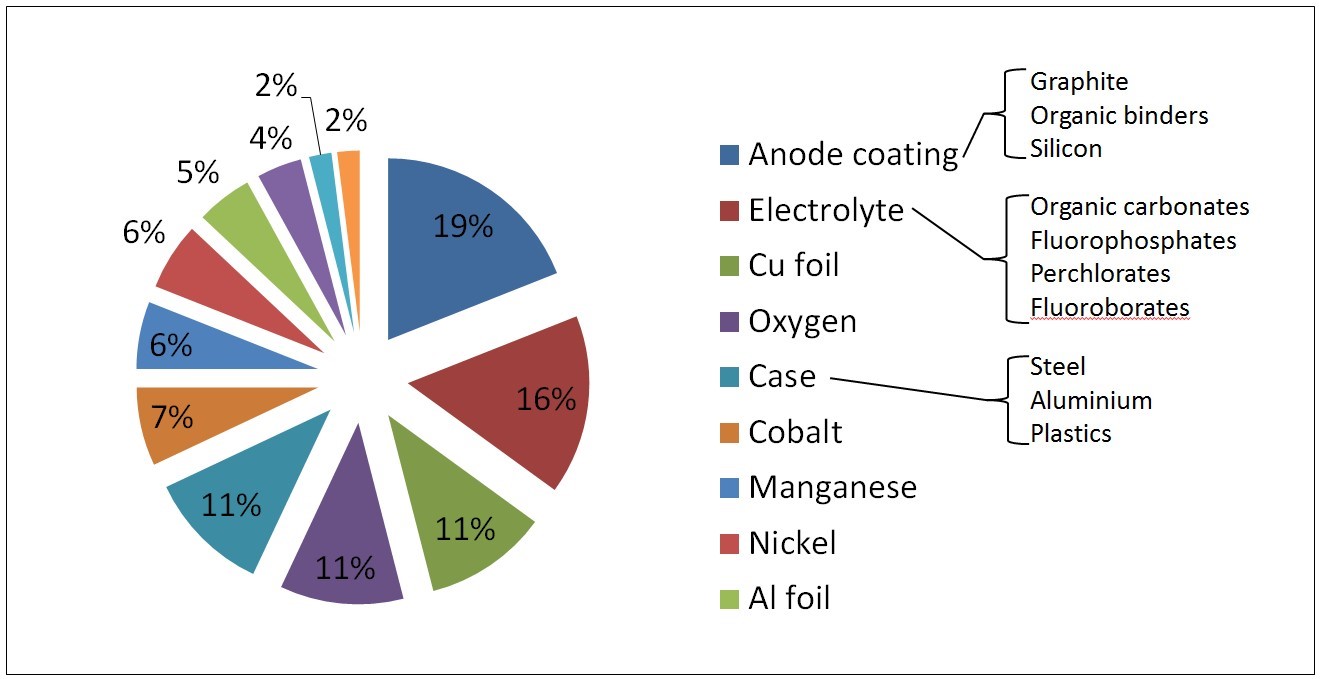

From a process development standpoint, the recovery of constituents from li-ion batteries presents a unique challenge compared to traditional primary metal resources due to the highly heterogeneous nature of the feed material. Currently, there are at least 14 different types of li-ion battery cathode chemistries currently existing in the market [3], each of which has even further permutations when considering specific constituents. With traditional metal resources the primary concentrate stream might have 1-4 elements to be recovered (e.g. copper, gold, silver and platinum). Li-ion batteries may however contain over 20 elements that demand consideration for recycling as illustrated by the example composition in Figure 3 [5]. In addition, the metal values are typically contaminated with inorganic materials, organic materials and plastics, further complicating the recycling process. To be able to separate out the valuable constituents typically requires complex process flowsheets with many individual unit operations. Under this scenario, it is critical that the physical test-work required to develop the process flowsheet is well focused and driven by techno-economic analysis.

Li-Cycle is one company with a strong focus on technology for resource recovery of end-of-lifecycle li-ion batteries. Since incorporation in 2016, Li-Cycle has developed and validated a unique process to recover 80-100% of all li-ion battery constituent materials using a two-step mechanical and hydrometallurgical system. This advanced resource recovery process, alongside concentrated efforts focused on battery sourcing from various supply chain players and a continuous prioritisation of safety, are fundamental elements supporting Li-Cycle’s goal of global commercialisation of Li-Cycle Technology.

Opportunities and future outlook

It is evident that the global volume of li-ion batteries deployed in energy storage and other applications is set to increase steadily over the next two decades, underscoring the necessity for a sustainable end-of-life pathway for these batteries both now and into the future. Li-Cycle is on a mission to leverage its innovative solution to address an emerging and urgent global challenge. Li-ion batteries are increasingly powering our world and there is a need for improved technology and supply chain innovations to better recycle these batteries, and to meet the rapidly growing demand for critical and scarce battery-grade materials. Scalability, low-cost, safety and environmental sustainability are core tenets of commercialising Li-Cycle Technology. In turn, Li-Cycle seeks to enable the global transition to electro-mobility and reduce greenhouse gas emissions worldwide. Lithium-ion batteries will continue to electrify our world, now and into the foreseeable future. As a key driver of the transition away from a carbon-based economy, li-ion batteries are integral to the opportunity to drastically reduce greenhouse gas emissions worldwide. However, to ensure a truly positive impact over their lifecycle, we must ensure a closed-loop system is in place to safely handle and recycle spent li-ion batteries at scale. This will enable the reintegration of critical battery materials into the li-ion battery supply chain and the broader economy, while preventing negative environmental and safety impacts.