Shell first announced its intention to exit its joint ventures with Russia’s Gazprom and related entities about a week ago. These include a 27.5 per cent stake in the Sakhalin-II liquefied natural gas (LNG) facility, its 50 per cent stake in the Salym Petroleum Development, and the Gydan energy venture. Shell also revealed the intention to end its involvement in the Nord Stream 2 gas pipeline project.

In a new update related to its Russian operations, Shell said on Tuesday it intends to withdraw from its involvement in all Russian hydrocarbons, including crude oil, petroleum products, gas and liquefied natural gas (LNG) in a phased manner, aligned with new government guidance. As an immediate first step, the company will stop all spot purchases of Russian crude oil. It will also shut its service stations, aviation fuels and lubricants operations in Russia.

Shell Chief Executive Officer, Ben van Beurden, said: “We are acutely aware that our decision last week to purchase a cargo of Russian crude oil to be refined into products like petrol and diesel – despite being made with the security of supplies at the forefront of our thinking – was not the right one and we are sorry.”

Namely, as reported by Reuters last Friday, Shell bought a cargo of Russian crude oil from Swiss trader Trafigura in S&P Global Platts window loading from Baltic ports at a record low of dated Brent minus $28.50 a barrel. According to Reuters, it was the first Russian crude deal in weeks to be seen in the window and the first trade of Russian crude since the invasion of Ukraine began on 24 February 2022.

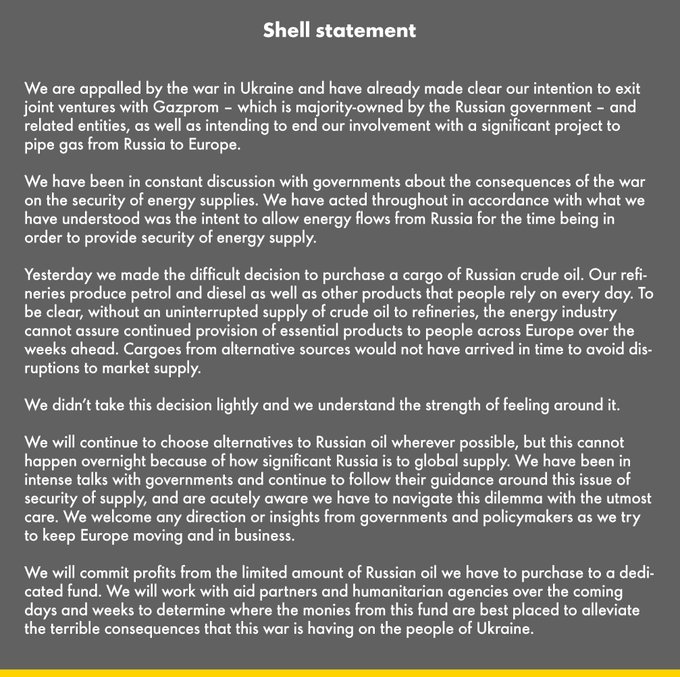

Shell defended the decision to buy the Russian crude in a statement on Saturday, saying it would commit profits from the oil to a dedicated fund.

In the statement on Tuesday, Ben van Beurden further added: “As we have already said, we will commit profits from the limited, remaining amounts of Russian oil we will process to a dedicated fund. We will work with aid partners and humanitarian agencies over the coming days and weeks to determine where the monies from this fund are best placed to alleviate the terrible consequences that this war is having on the people of Ukraine.”

Shell CEO also added that the company’s actions have been guided by continuous discussions with governments about the need to disentangle society from Russian energy flows, while maintaining energy supplies.

“Threats today to stop pipeline flows to Europe further illustrate the difficult choices and potential consequences we face as we try to do this,” he said.

As a result, Shell will immediately stop buying Russian crude oil on the spot market and will not renew term contracts. At the same time, in close consultation with governments, Shell is changing its crude oil supply chain to remove Russian volumes.

“We will do this as fast as possible, but the physical location and availability of alternatives mean this could take weeks to complete and will lead to reduced throughput at some of our refineries,” van Beurden said.

Furthermore, Shell will shut its service stations, aviation fuels, and lubricants operations in Russia. While considering very carefully the safest way to do this, Shell said the process will start immediately.

Finally, Shell will start its phased withdrawal from Russian petroleum products, pipeline gas, and LNG. This is a complex challenge, Shell emphasised. Changing this part of the energy system will require concerted action by governments, energy suppliers and customers, and a transition to other energy supplies will take much longer, the company explained.

“These societal challenges highlight the dilemma between putting pressure on the Russian government over its atrocities in Ukraine and ensuring stable, secure energy supplies across Europe,” said van Beurden.

“But ultimately, it is for governments to decide on the incredibly difficult trade-offs that must be made during the war in Ukraine. We will continue to work with them to help manage the potential impacts on the security of energy supplies, particularly in Europe,” he concluded.

The security of energy supply has been at the forefront of thinking for global governments as well as the oil and gas industry since the attack on Ukraine started. Last week, the U.S. and 30 other IEA members decided to release about 60 million barrels of oil from strategic reserves in an effort to stabilise the global energy markets as oil prices have been running wild due to major supply concerns.

The latest report from Reuters says oil prices rose again on Tuesday with Brent surging past $127 a barrel, as the possibility of formal U.S. sanctions against Russian oil exports spurred concerns over supply.