Developments in China are the key risk to thermal coal prices and a reduction in its overseas purchases could push prices even lower, Australia’s Department of Industry, Innovation and Science wrote in its quarterly report, forecasting spot Newcastle coal will trend lower through to 2021 before stabilizing. Changes to Chinese policy were thrust into the spotlight earlier this year as the nation slowed customs clearance of Australian coal.

“As highlighted in the last few months, forecasting China’s thermal coal imports is underpinned by considerable risks due to the sheer size of its domestic coal industry and ongoing policy uncertainty,” Australia’s commodity forecaster wrote in its March quarterly report released Friday.

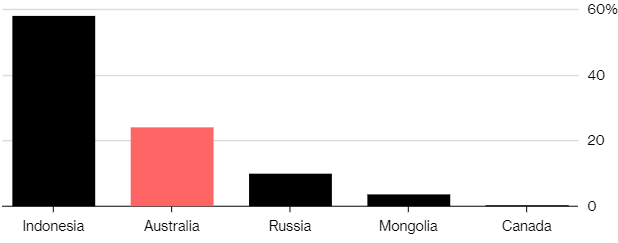

China Dependence

Almost a quarter of China's 2018 thermal coal imports came from Australia

Source: Australia's Department of Industry, Innovation and Science

Key Insights

China’s domestic coal output has been a major factor impacting imports over the past three years and is expected to remain so after undergoing substantial structural reforms

About 200 million tons of capacity is ready to start production this year, more than offsetting 100 million tons of closures, while there is a further 400 million tons of approved capacity under construction

China’s thermal coal imports are projected to decline through 2024, falling to 209 million tons in 2019 and 194 million tons in 2020, compared to 216 million tons in last year

Newcastle coal is forecast to slip to $92/ton in 2019 and $84 in 2020 from an average of $105 last year. Prices are projected to stabilize at $80 in 2021 as a lack of new projects constrains supply