Green infrastructure developer Cerulean Winds, which wants to build 200-turbine floating wind and hydrogen project in Scotland, has signed an agreement with px Group, the UK-based operator of large-scale industrial facilities.

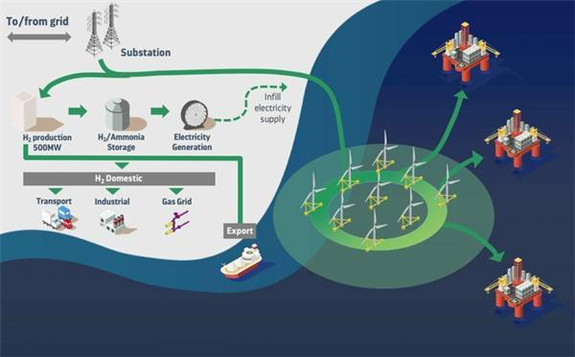

Cerulean in June filed plans to develop a $14 billion, 3GW floating wind turbine project at sites West of Shetland and in the Central North Sea, feeding power to the offshore oil and gas platforms and excess 1.5 GWh power to onshore green hydrogen plants.

The company says its project has the capacity to generate 3GWh of power, enough to electrify the majority of offshore facilities, reducing CO2 emissions by more than half from 2025. An excess of 1.5 GWh of power would be diverted to onshore green hydrogen plants, per Cerulean.

The three onshore hydrogen sites would be located in the North of England, North-east Scotland and on Shetland.

Under the agreement, px Group would be responsible for lease and ownership arrangements for the sites and for obtaining planning permissions and permitting. This would include obtaining the outline approvals prior to more detailed engagement with local government, regulatory and environmental stakeholders.

"px Group, which owns Saltend Chemicals Park in Humber, manages, operates, and maintains some of the UK’s largest industrial facilities, including the NSMP St Fergus Gas Terminal near Peterhead. This new agreement would see px Group operate the hydrogen generation facilities and the associated onshore infrastructure, including the onshore substations and grid connections," Cerulean said.

“px Group’s expertise and asset base make it a valuable addition to Cerulean’s UKCS decarbonization proposition,” said Dan Jackson, Cerulean Winds founding director.

Floating wind turbine illustration - Credit: Cerulean“This project which would see the offshore industry helping cut emissions from onshore industrial sites is a real turning point in the shift towards a joined-up approach to tackling accelerating the decarbonization of the UK’s on and offshore industrial facilities.

“The North Sea Transition Deal calls for a reduction in offshore emissions of 10% by 2025, rising to 25% in 2027 and 50% by 2030. The Cerulean proposal would exceed these targets. Crucially though, the green power would be used to generate green hydrogen which can be used to decarbonize other industrial sectors.

“That lines us up to put us on a par with other countries such as Germany which has taken the decision to decarbonize its heavy industries and is actively looking at how to use green energy from wind farms to do that.”

Geoff Holmes, px Group CEO said: “We are delighted to be working with Cerulean on this potentially ground-breaking project. As an owner and an operator, px Group has over 25 years hands-on experience in developing cleaner energy projects and reducing emissions. Operating and managing infrastructure which supports the UK’s energy transition is core to our business and we are thrilled to be able to support the decarbonization of offshore facilities in the North Sea.”

Cerulean said that the progression of its £10 billion green infrastructure plan hinges on a decision from Marine Scotland.

The company said it had made a formal request for seabed leases, asking that the Scottish and UK governments make an “exceptional” case to deliver an “extraordinary” outcome for the economy and environment.

A favorable decision, says Cerulean, must be made by Q3 this year to progress the scheme to meet the timescales set out in the North Sea Transition Deal.

“Timing is absolutely crucial in this,” said Jackson. “Everything hinges on those leases being granted, even conditionally, by this autumn so we can move ahead on schedule. The risk of not moving quickly on basin-wide decarbonization would wholly undermine the objectives set out in the North Sea Transition Deal and delay the potential of making a significant impact on reducing emissions from onshore industrial assets.”