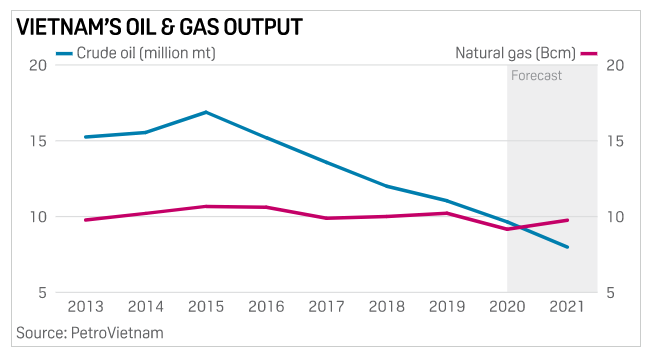

PetroVietnam and its foreign upstream partners have produced first condensate and gas from phase 2A project in Vietnam’s offshore Su Tu Trang field, the state-run oil and gas company told S&P Global Platts June 28 without providing estimated output volume.

A virtual ceremony held last week to mark the production was participated by representatives from PetroVietnam, its upstream arm PetroVietnam Exploration Production Corp., Perenco, Geopetrol and South Korea’s SK Innovation and Korea National Oil Corp., or KNOC.

The development plan for the phase 2A was approved by Vietnamese government in December 2019. With estimated CAPEX of around $140 million, the investors expect to produce 193 billion cubic feet of natural gas and 63 million barrels of condensate, or ultra-light crude oil, between June 2021 and September 2025.

Su Tu Trang is located in Block 15-1 in Cuu Long basin, about 62 km from Vung Tau city. PVEP holds 50% stake in the production sharing contract, which was signed in September 1998. The other stakeholders included Perenco (23.25%), KNOC (14.25%), SK Innovation (9%) and Geopetrol (3.5%).

The other operating fields in Block 15-1 are Su Tu Den, Su Tu Vang and Su Tu Nau. The total production from 68 wells in the four fields in Block 15-1 reached 40,000 b/d of oil and gas equivalent as of March.

Gas from Block 15-1 and other fields in Cuu Long basin are transported through pipelines run by PetroVietnam Gas to mainly serve power, fertilizer, and other industrial customers in southern Vietnam, according to PetroVietnam.

New condensate supply stream

South Korean upstream partners said the early phase of condensate output is small, but they are optimistic that the production could increase rapidly over the coming years, potentially making Vietnam a steady supply source for Asia’s much needed ultra-light crude oil.

Due to the absence of Iran’s abundant South Pars condensate supply over the past few years due to international sanctions on Tehran, Asia’s main condensate supply sources have been limited to just Qatar and Australia.

South Korean refiners and petrochemical companies are especially keen to expand condensate supply sources as ultra-light crude oil and naphtha are base feedstocks for petrochemical products which are essential in medical equipment and hygiene product manufacturing.

“Although South Korea and other petrochemical makers and refiners would rely heavily on Qatar and Australia for condensate supply, emergence of new supply streams, big or small, would be more than ideal … hopefully Vietnam could provide at least one or two aframax cargoes of condensate per month in the Asian market by 2022 if not 2023,” a source at SK Innovation said.

With vaccination program picking up pace across East Asia, demand for certain petrochemical products like polypropylene and polyethylene, recorded a sharp uptick as these products are essential for making plastic disposable syringes and hypodermic needles, as well as protective medical suits and gears.

Condensate premiums

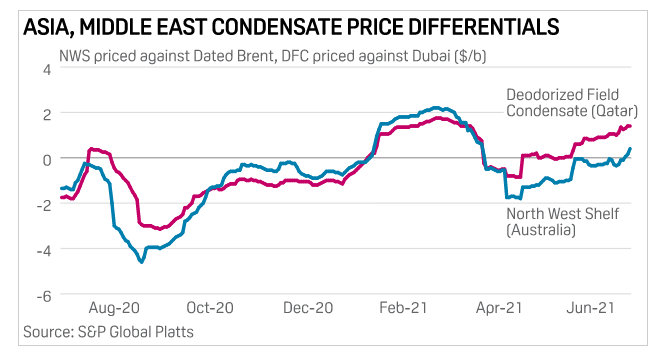

The start of phase 2A production comes at a strategically ideal time for PetroVietnam as both outright oil prices and spot market price differentials for condensate have been trending higher in recent trading cycles.

Various ultra-light crude grades in the regional market, including Australia and Malaysia, have changed hands at a premium, according to trade information and data collected by Platts.

Thailand’s PTT was reported to have purchased 300,000 barrels of Malaysia’s Cakerawala condensate for loaded in June 6-15 from Petronas at a premium of around 60 cents/b to Dated Brent.

Japanese uptsream company Inpex sold 650,000 barrels of Australian Ichthys condensate loaded in June 11-15 to ExxonMobil at a premium of around 20 cents/b to Dated Brent, according to trading sources based in Singapore with direct knowledge of the matter.

Australia’s flagship North West Shelf condensate was assessed at a premium of 45 cents/b to Dated Brent June 25, compared with averaged discount of $3.3/b in 2020, Platts data showed.

Meanwhile, Platts assessed outright sweet crude benchmark Dated Brent at $76.435/b June 25, a sharp rebound from the 2020 low of $13.24/b.