According to the report, World Energy Investment 2021, the Chinese government lowered restrictions on building new coal plants, giving a green light for construction in more provinces. Cambodia, Indonesia and Pakistan were other countries where coal-fired final investment decisions (FIDs) picked up in 2020. Those three countries together approved almost 5GW of new coal capacity in total. In India, the amount approved dropped below 1GW, its lowest level in a decade.

China’s coal-fired FIDs in 2020 were about 25% their 2010 level, India’s less than 5%. FIDs for gas-fired power plants edged down globally in 2020 but were still more than double those of coal (50GW versus 20GW). A large reduction in FIDs for new gas-fired capacity in the United States more than offset growth in parts of Asia (outside China and India).

Sushil Purohit, president at Wärtsilä Energy and EVP Wärtsilä Corporation, responded to the report: “It is encouraging to see an increase in clean energy investment this year, but make no mistake, we are miles away from where we need to be in order to rapidly decarbonise our systems and avoid catastrophic climate change.

“The narrative over the past year has been focused on how we can build back better following COVID-19, but so far the opportunity has been missed, as clean energy investment needs to more than triple in order to keep the door open for a 1.5°C stabilisation.”

Post-COVID recovery

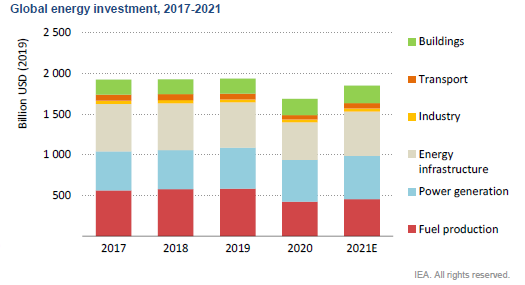

The report indicates that global investment in energy is set to rebound by nearly 10% in 2021 to $1.9 trillion, reversing most of last year’s drop caused the pandemic.

With energy investment returning to pre-crisis levels, its composition is continuing to shift towards electricity: 2021 is on course to be the sixth year in a row that investment in the power sector exceeds that in traditional oil and gas supply, according to the report.

Global power sector investment is set to increase by around 5% in 2021 to more than $820 billion, its highest ever level, after staying flat in 2020.

Renewables are dominating investment in new power generation capacity and are expected to account for 70% of the total this year. The report states that the investment now goes further than ever in financing clean electricity, with a dollar spent on solar PV deployment today resulting in four times more electricity than ten years ago, thanks to greatly improved technology and falling costs.

“The rebound in energy investment is a welcome sign, and I’m encouraged to see more of it flowing towards renewables,” said Fatih Birol, the IEA’s Executive Director. “But much greater resources have to be mobilised and directed to clean energy technologies to put the world on track to reach net-zero emissions by 2050. Based on our new Net Zero Roadmap, clean energy investment will need to triple by 2030.”

Oil & gas

Upstream oil and gas investment is expected to rise by about 10% in 2021 as companies recover financially from the shock of 2020, but their spending remains well below pre-crisis levels.

Oil majors are holding oil and gas spending flat on aggregate in 2021, despite recovering prices. Meanwhile, some national oil companies are stepping up investment, raising the possibility of increased market share if demand continues to grow.

There are signs in the latest data that spending by some global oil and gas companies is starting to diversify. IEA’s analysis last year highlighted that only around 1% of capital spending by the industry was going to clean energy investments. But project tracking to date in 2021 suggests that this could rise to 4% this year for the industry as a whole, and well above 10% for some of the leading European companies.

Financial markets

The influence of recovery packages and new climate policy measures comes through in expectations of rising expenditure in 2021 on renewable power, electricity grids, energy efficiency – notably in the buildings sector in Europe – and emerging technologies such as carbon capture, utilisation and storage and low-carbon hydrogen.

Sustainable debt issuance reached a record level in 2020, and renewable power companies have outperformed fossil fuel companies on international equity markets. But even though spending on clean energy is set to rise in 2021 by around 7%, the report notes that growth in these capital expenditures has lagged changes in financial markets, in part due to a shortage of high-quality clean energy investment opportunities and appropriate channels for allocating capital into projects.

Dr Birol said: “Clear policy signals from governments would reduce the uncertainties associated with clean energy investments and provide investors with the long-term visibility they need. Our Roadmap shows there are huge opportunities for companies, investors, workers and entire economies on the path to net zero. Governments have the power to unlock these broad-based benefits.”

The sentiment is shared by Sushil Purohit: “World leaders must grasp this crucial advice from the IEA and rally around the COP26 summit to enable a huge increase in renewable energy deployment, matched with the flexible generation technology and battery storage that is required to support it.”