Australian energy giant Santos has taken a final investment decision (FID) to proceed with Barossa, the $3.6 billion gas and condensate project, located offshore Australia.

Santos is the operator of the Barossa gas field, which is located 300 kilometres offshore Darwin in Australia.

The company said on Tuesday that the Barossa FID also kick-starts the $600 million investment in the Darwin LNG life extension and pipeline tie-in projects, which will extend the facility life for around 20 years.

The Santos-operated Darwin LNG plant has the capacity to produce approximately 3.7 million tonnes of LNG per annum.

According to Santos, Barossa is one of the lowest cost, new LNG supply projects in the world and will give Santos and Darwin LNG a competitive advantage in a tightening global LNG market.

The project represents the biggest investment in Australia’s oil and gas sector since 2012.

Santos Managing Director and Chief Executive Officer Kevin Gallagher said: “Our strategy to grow around our five core asset hubs has not changed since 2016. As we enter this next growth phase, we will remain disciplined in managing our major project costs, consistent with our low-cost operating model”.

He added: “Barossa and Darwin LNG life extension will create 600 jobs throughout the construction phase and secure 350 jobs for the next 20 years of production at the Darwin LNG facility.

“Less than a year since we completed the acquisition of ConocoPhillips’ northern Australia and Timor-Leste assets and despite the global economic impact of a once-in-a-hundred-year pandemic, it is a great achievement to have extended the life of Bayu-Undan following the approval of the infill drilling program and now to have taken FID on the Barossa project”.

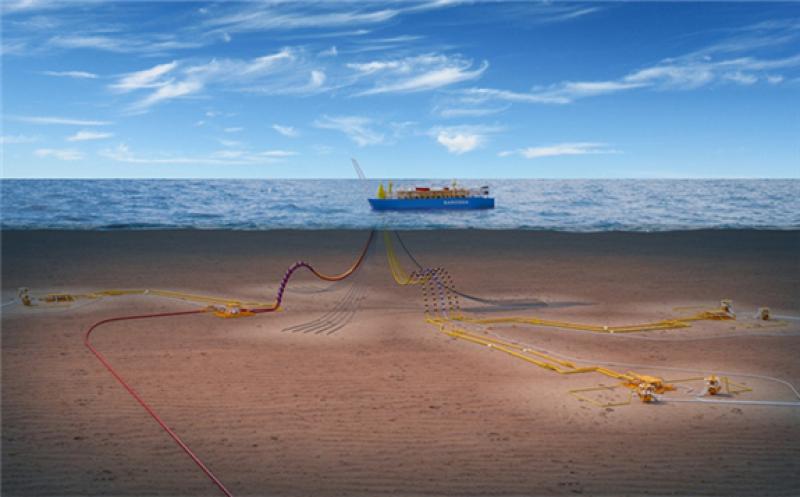

The Barossa development will comprise an FPSO vessel, subsea production wells, supporting subsea infrastructure, and a gas export pipeline tied into the existing Bayu-Undan to Darwin LNG pipeline. First gas production is targeted for the first half of 2025.

Santos has also recently awarded a contract for the Barossa FPSO to BW Offshore. The lease and operate contract has a firm period of 15 years, with 10 years of options. The firm period contract value is $4.6 billion.

The contract award to BW Offshore was subject to the FID for the project and represents the largest capital expenditure component of the project.

The FID has now confirmed BW Offshore’s contract for the supply of the FPSO to the Barossa gas field is effective as of 30 March 2021.

At the end of last year, Santos announced the tolling arrangements had been finalised for Barossa gas to be processed through Darwin LNG and that Santos had signed a long-term LNG sales agreement with Diamond Gas International, a subsidiary of Mitsubishi Corporation, for 1.5 million tonnes of Santos-equity LNG for 10 years with extension options.

Santos has also signed Memoranda of Understanding with SK E&S and Mitsubishi to jointly investigate opportunities for carbon-neutral LNG from Barossa, including collaboration relating to Santos’ Moomba CCS project, bilateral agreements for carbon credits and potential future development of zero-emissions hydrogen.

“We will continue to explore the potential for carbon-neutral LNG from Barossa as part of our commitment to lower global emissions and as a company, reach our net-zero emissions target by 2040”, Gallagher said.

Barossa FID is the final condition required for completion of the 25 per cent equity sell-downs in Darwin LNG and Bayu-Undan to SK E&S, which is also a partner in Barossa.

Santos said that the completion of the SK transaction is expected to occur at the end of April and result in net funds to Santos of approximately $200 million, being the sale price of $390 million less the forecast cashflows from the 25 per cent interests from the effective date of 1 October 2019 to completion.

Santos and JERA continue to progress the binding sale and purchase agreement for JERA to acquire a 12.5 per cent interest in Barossa.

Completion of the sell-downs to SK E&S and JERA will see Santos’ interests in Bayu-Undan and Darwin LNG change to 43.4 per cent, and in the Barossa project to 50 per cent.

The Barossa investment decision will see approximately 380 million barrels of oil equivalent resources commercialised to 2P reserves at Santos’ expected 50 per cent interest in the project following the sell-down to JERA.

This article is reproduced at www.offshore-energy.biz