Argus assessed NAR 5,800kcal/kg coal 19¢/t lower on the week at $86.64/t cfr South Korea this week, while the equivalent fob Newcastle assessment rose by $2.29/t to $72.72/t.

State-owned utility Korea Western Power cancelled a five-year term tender for around 2mn t of coal on 11 March because of high prices, according to market participants. The utility was seeking NAR 5,000-5,499 kcal/kg or NAR 5,500-6,000 kcal/kg coal for delivery over five years and reportedly received offers around the mid-$90s/t on a cfr South Korea basis, with the lowest at around $85/t.

Australian NAR 5,800 kcal/kg fob prices strengthened in tandem with the high-calorific value market, with production in the Hunter Valley region still tight as a result of inclement weather and supply disruption since late last year. Demand from Japanese utilities for restocking has also offered support in recent weeks.

South Korea's latest import data showed a surge in Australian coal receipts in February despite weak coal burn, which may also suggest tighter domestic stocks in South Korea following a period of low imports throughout 2020.

Rising domestic gas prices and strength in the oil market, which will support oil-linked LNG prices in the months ahead, may also have prompted utilities to up their coal procurement for the peak cooling months.

But firmer freight rates, coupled with milder weather, deterred South Korean buyers this week, weighing on prices on a delivered basis. The average Capesize freight rate between eastern Australia and southern China jumped by $1.55/t on the week to $13.42/t this week, increasing for a second consecutive week.

Outages at some coal units were extended this week, possibly as milder forecast temperatures and firm nuclear availability boosted the authorities' short-term electricity supply confidence. The extensions included the 560MW Samcheonpo 1 and 2, 500MW Hadong 5 and Taean 1, according to the latest plan released by the Korea Power Exchange.

Based on the current schedule, state-owned Kepco utilities' coal availability will average 19.6GW in March, down from 21.3GW based on the data available last week. The government caps winter output at 80pc of available capacity, which means generation should be limited to 15.7GW this month. Kepco's coal-fired generation averaged 16.5GW in March 2020, which was 77pc of the available capacity.

Speedwell Weather data shows Seoul's temperatures were around 4.19°C above the seasonal average today and are forecast to remain above the average by as much as 5.63°C over the next fortnight. Temperatures in Tokyo are also expected to remain above the historic average during the same period.

And South Korea's nuclear availability is scheduled to average 20GW this month, compared with 19.4GW output a year earlier. Meanwhile, state-owned utilities' coal-fired power generation decreased by 4pc — or 1GW — on the year to 23.8GW in January, according to Kepco's latest power report. Overall power demand increased by 4.4GW on the year to 71.5GW, but this was met with 2.9GW and 1.9GW increases in nuclear and gas-fired output, respectively, while coal burn fell because of plant restrictions.

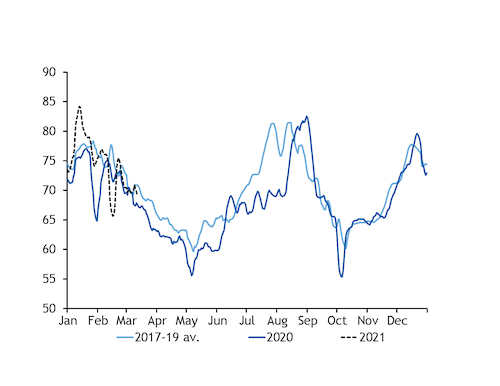

Seven-day average peak power demand GW