Ultrathin, incredibly strong, superconductive, cheap--and impossible to use. Those are some of the unfortunate oxymorons that have been used to describe graphene, the gee-whiz nanomaterial that was supposed to forever change the face of materials science as we know it. Yet, save for a few novel applications, the graphene promise has mostly remained mere hype 16 years after two Manchester University professors first figured a way to extract it from graphite. But a cross-section of experts now believes that graphene's big moment might have finally arrived.

Some starry-eyed scientists have predicted that a graphene superbattery that will charge faster, hold more power, and cost less than conventional lithium batteries might be just around the corner.

Graphene startup Nanograf has partnered with a power tool company as well as another company that manufactures EV batteries to bring its technology to market as soon as next year.

Wall Street appears to concur, and graphene stocks have been enjoying a big comeback after receiving a shellacking in recent years.

Applied Graphene Materials Plc. (OTCQB:APGMF) is up 108.8% in the year-to-date

First Graphene Limited (OTCMKTS:FGPHF) has gained 54.4%

Haydale Graphene Industries Plc. (OTCMKTS:HDGHF) is up 225.0%

AIXTRON SE (OTCMKTS:AIXXF) 35.9%

Zen Graphene Solutions Ltd. (OTCMKTS:ZENYF) has racked up gains of 342.2%

Graphene 'Superbattery'

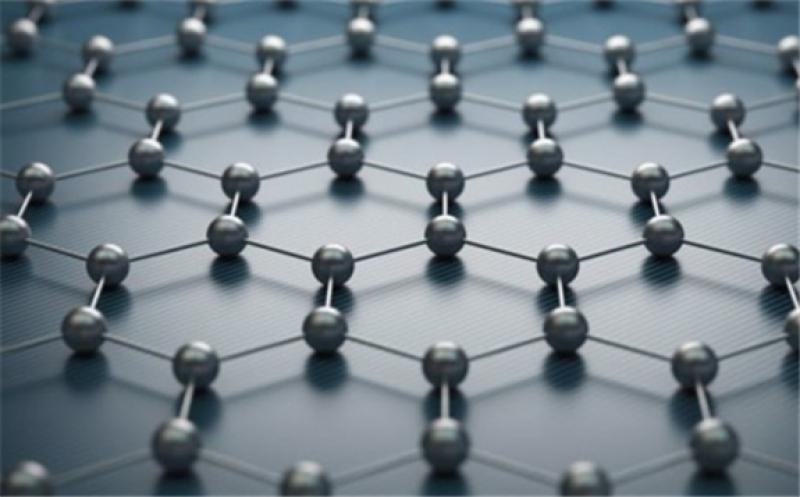

The graphene molecular structure consists of a thin sheet of carbon atoms a single atom thick, making it the world's thinnest material. This gives the material an extremely high surface-area to volume ratio, a very useful quality in batteries and supercapacitors.

Nanograf has incorporated graphene into lithium batteries to produce super-batteries that not only charge faster but also dissipate heat more effectively than standard batteries.

This has several big implications. Such batteries used in power tools means that they don't overheat as quickly, thus allowing home appliances to last longer. They also charge faster, a particularly useful feature for batteries used in electric vehicles.

Indeed, NanoGraf says its graphene batteries have demonstrated a 50% increase in run-time compared to conventional lithium-ion batteries, a 25% drop in carbon footprint while also cutting the overall weight of the battery by half for a similar output.

It all boils down to the superior qualities of graphene compared to lithium. Although lithium rules the battery world, it's actually a rather poor conductor of electricity and tends to physically deform as it discharges.

These drawbacks can be overcome by mixing or coating the lithium with graphene or using related nanomaterials such as graphene oxides as well as reduced graphene oxides. Graphene is not only a much better conductor than lithium but is also much stronger, which helps the lithium structure to maintain its integrity thus allowing for longer battery life.

The biggest benefit for the EV industry: Graphene's sturdiness allows batteries to take a lot more punishment by withstanding many more life cycles than conventional batteries. This allows them to be pushed harder by charging them faster with higher electric currents. The abundance of discharge cycles allows them to last longer than conventional batteries.

Nanograf is not the only startup going down this path. Real Graphene has told Futurism that it has developed a graphene technology that can charge an EV battery in well under an hour. Company CEO Samuel Gong says the company is actually piloting buses powered by its graphene tech but has declined to name the bus company or offer any details regarding whether the batteries are living up to expectations.

Speculative stocks

Ultimately, the majority of graphene companies will remain speculative investments until they are able to establish viable revenue streams. To date, most companies in the space are plagued by thin revenues and high cash burn, making them risky investments.

To be fair, the sector faces much better prospects now than it did a decade ago thanks to battery costs having come down dramatically, plus the massive ESG momentum. But unlike a sector like hydrogen, which is enjoying major backing internationally, a lot of the research on graphene is being carried out by small startups that might lack the wherewithal to quickly bring their products to the market. Tesla Inc. (NASDAQ:TSLA) is rumored to be pursuing a graphene battery, though it has declined to comment on the matter.

Further, don't expect a graphene superbattery to power your EV any time soon. As Nanograf VP of business development Chip Breitenkamp has noted, batteries that go into EVs require extremely long test cycles of three or four years at a minimum.

Battery and graphene startup Nanotech Energy appears to be ahead of the pack in this regard. The company recently reported that it has closed a $27.5 million funding round, giving it a post-funding valuation of $227.5 million. This brings its total funding to more than $30 million since its founding in 2014. The investors, though, were not disclosed.

According to Nanotech Energy CEO Jack Kavanaugh, the company plans to use the funding to develop a non-flammable, environmentally friendly lithium battery that can charge "18x faster than anything currently available on the market." The company hopes to release the prototype sometime within the next year.

This article is reproduced at oilprice.com