Net EU-27 thermal coal imports fell on the year for a 16th consecutive month in June amid weak consumption and prices in the Atlantic. But the drastic supply-side adjustment in 2020 now poses upside risk for prices ahead of the winter, as the decline in power sector coal consumption is expected to slow in the second half of the year.

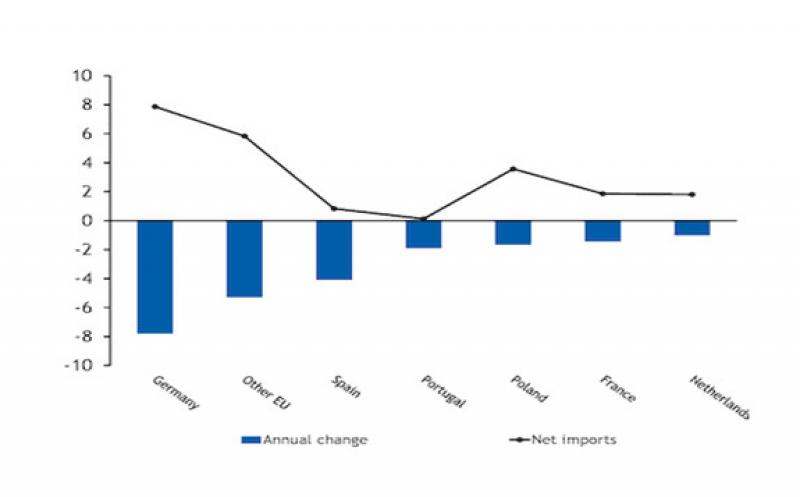

Net EU-27 coal imports mn t

The EU imported a net total of 3.3mn t of thermal coal in June according to Eurostat data, broadly in line with May and down by 2.3mn t on the year. The receipt brought total first-half imports to the EU and UK to 23.1mn t, which was 51pc lower on the year and the lowest January-June total since 1988.

EU import demand has been pressured by a sustained drop in coal-fired power generation amid rising renewable generation and competition from gas over the past two years. But the decline in demand has also weighed on physical coal prices and squeezed seller margins, resulting in a particularly steep drop in supply so far in 2020 and a tighter fundamental balance.

German coal imports outpaced implied power sector consumption of NAR 6,000 kcal/kg-equivalent coal by more than 1mn t/month in January-June 2019, but this overhang has fallen to 480,000 t/month in 2020, according to Argus estimates.

The fundamental picture may tighten further in the second half of the year, with supply availability in the Atlantic likely to be constrained by weaker US and Colombian exports. And EU coal burn is set to decline less sharply on the year compared with the first half of 2020 and record a modest seasonal recovery into the winter.

Aggregate coal-fired power generation in Germany, Spain, France and the UK fell by around 4GW on the year in January-July according to grid operator data, which is equivalent to 980,000 t/month of NAR 6,000 kcal/kg consumption.

But year-on-year consumption is likely to fall by up to 620,000 t/month in August-December according to Argus analysis, as overall power demand recovers and coal-gas fuel switching economics ease with the onset of the winter heating period.

This outlook assumes a 5pc drop in overall power generation in the four countries and coal accounting for a 10pc share of total fossil fuel generation, after the fuel's share fell by 5 percentage points on the year to 12pc in January-July.

But the year-on-year decline in coal burn would be less severe if power demand is more robust or if the fuel retains a share of fossil fuel generation close to the 14pc it achieved in August-December last year. Flat overall power demand and a 14pc share of fossil fuel generation would potentially cut coal use by only 110,000 t/month on the year in August-December, under Argus analysis.

Net EU-27 coal imports were down on the year by an average of 3.9mn t/month in January-July at 3.7mn t/month. Last year, August-December receipts averaged 5.9mn t/month.

The overall decline in EU-27 imports this year has been driven by Germany, which accounted for a third of the 23.1mn t total reduction. Spain, Portugal and Poland accounted for a further 4.1mn t, 1.9mn t and 1mn t of the decline, respectively.