During SNEC 2019 in Shanghai, PV Tech and Chinese conductive paste leader DK Electronic Materials (DKEM) discussed trends in metallization and interconnection and the need for close collaboration among the value-chain to drive innovation for efficient PV products.

Also, PV Tech learned at the show how suppliers view the development of efficient cell and module technology and their predictions of which next-generation technology will rise to the top.

“As one of the leading supplier of conductive silver pastes for PV cells, DKEM, at present, has strengthened R&D capability for material innovation and strategically engaged with tier 1 customers for the ramping up of cost-effective poly technology, PERC LDSE technology with different rear-side passivation approaches and n-TOPCon passivated contact technology,” says Dr. Shi Weili, CEO, DKEM. “High-efficiency cell and module technologies will spring up in the future as a result of commitments to the material/equipment/process innovations across the value chain. However, for the sustainable growth of PV industry, everyone in the supply chain should make prudent judgments on which new technology will prevail and eventually be widely utilized.”

Consensus among major module manufacturers critical for mass adoption of MBB

DKEM is one of the key solar cell material suppliers offering high-performance conductive silver pastes and metallization solutions to cell makers. The company’s product strategy reflects the current development status of efficient PV technologies from another point of view.

Half-cut plus multi-busbar (MBB) modules are the mainstream products right now, which was clear from the exhibits of various module manufacturers at SNEC 2019. Almost every supplier launched its own modules of this type. This year also heralds the coming of MBB multi-busbar technology. Such signals have already been passed onto the cell supply chain and have triggered a stronger demand for customized conductive paste.

“To be more specific, MBB and other busbar designs are technologies for modules, not new ones for cells,” explains Dr. Shi. “When we launched DK91 silver pastes three years ago, it had already met or even exceeded MBB cell and module requirements. Indeed, we have been cooperating with tier 1 vertically integrated PV module makers to meet their customized needs on finger thickness, paste consumption and solderability for their integrally designed MBB cells and modules,” Dr Shi added.

In the past few years, industry efforts have been concentrated on resolving issues and improving processes in modularization of MBB technology, including equipment upgrades, soldering yield, supporting module materials, long-term reliability and more competitive combining technologies to open up the downstream market.

“For example, major module makers were not able to reach a consensus on 12BB and 9BB until late last year,” says Dr. Shi. “Modularization progress and industry consensus are key to the wide application of MBB modules in 2019. However, it has been two or three years since cell sector got fully prepared.”

Manufacturing chain reaction triggered by +400W modules

The memory of SNEC 2018 is still fresh. All major PV suppliers launched their +300W modules. One year later, all reached +400W while a few firms even showcased +500W super modules. The industrial wave has been advancing module output quickly towards 3.0, 4.0 or even 5.0.

In order to further improve module output power, module makers need to consider a bottom-up approach and partnership with wafer and cell makers. Module efficiency could be boosted with the increase of wafer size. Such an “edge” innovation is becoming one of the research directions for major PV enterprises, who are hesitating over which size to choose from, 158.75, 161.7 or 166mm.

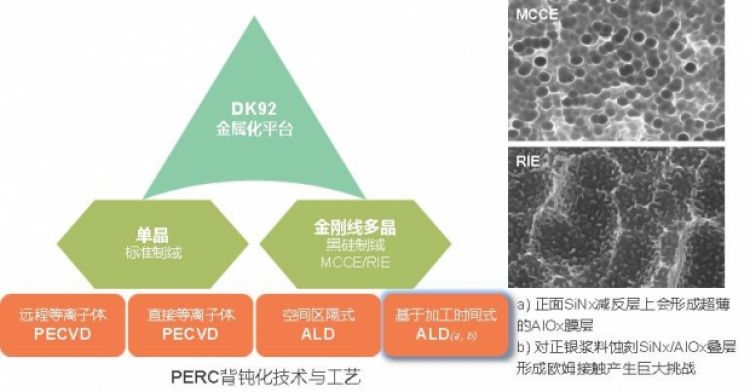

Cell technologies which can achieve higher efficiency for mono and poly cells in the short-term have attracted unprecedented interest. Among them are continuous optimization of passivation technology, diffusion/LDSE technology and metallization development for high-efficiency mono PERC technology. TOPcon passivated contact technology with minor upgrade/investment of existing equipment is on the top of the most promising next-generation PV technologies.

As a crucial partner in the development of solar cells, conductive paste suppliers are always invited to participate in the R&D of various record-breaking cells and to support the development of next-generation PV technologies.

In order to meet its customers’ needs, DKEM has already developed and launched a broad spectrum of new products. “To tap the potential of cost performance of poly cells, we have designed DK93A conductive silver paste, which can significantly reduce the silver consumption while increasing poly cell efficiency. For the mono PERC LDSE cells, we have developed DK93B conductive silver paste to further reduce recombination level under metallization region,” says Dr. Shi.

“Furthermore, the double-AlOx passivated PERC technology, enabled by our metallization technology, has already been producing in observably large capacity. Also, DKEM believes that with the continuous improvement of sheet resistance for mono PERC LDSE cells, our double printing and dual printing solutions of DK93D/DK81A and DK93B/DK81A will play a critical role to achieve even higher efficiency.

“For TOPCon passivated contact technology, we have collaborated with top European research institute ECN TNO and successfully developed DK93T conductive silver paste, which is essential to control J0, metal, Rcontact and micro-interface. The results have been presented and published as a proceeding at Metallization & Interconnection Workshop 2019. ”

DKEM claims that the double-AlOx passivated PERC technology promoted by it has been mass-produced for more than 10GW. Similarly, outstanding progress in TOPCon metallization has also been achieved. Super efficiency over 23% has been achieved on 60nm Poly-Si layer through joint collaboration with the company's strategic customer.

In addition, over the past two years, DKEM also put forward the concept of ‘Collaborative Innovation’ to bridge cell metallization with module interconnection, which is reflected in the dual printing metallization technology for MBB modules and shingled modules. It is known that such a practice has already been adopted by tier 1 vertically integrated manufacturers in mass production and has achieved a good balance of cost and reliability. A systematic and synergetic thinking over the interconnection mechanism and reliability of conductive silver paste and electrically conductive adhesive (ECA) has driven DKEM to launch DECA100 series ECAs for shingled modules.

“There are at least three aspects of Collaborative Innovation proposed by DKEM. Firstly, the development rate of high-efficiency solar cells and modules will be further accelerated if we could build up customer-centric collaboration together with equipment and materials suppliers. Secondly, since future PV energy is terminal-oriented, the synergetic development and optimization of cell and module technologies could better realize the Integrated Product Development(IPD) of terminal products of PV modules. Thirdly, Collaborative Innovation is an extended concept of modern organizational management to push boundaries and to break the barriers between different functions, such as cell teams and module teams, etc., to further improve organizational efficiency eventually,” Dr Shi explained.

Product logic in the time of grid parity

With the approaching of grid parity, the whole industry is getting more and more strict with manufacturing cost control. Cost-effective technologies and products featuring higher cost-efficiency will be more attractive in the marketplace. The cost of conductive pastes accounts for more than 50% of the total non-silicon cell cost. Such a high cost cannot be ignored and have become a crucial link.

For front-side conductive silver paste, silver consumption still remains an important issue for cells. The whole industrial chain needs to take some measure in cost structure before the coming of grid parity.

"We have been working diligently to reduce cost and silver consumption, which are also the key indicators of our product development. DK93 itself boasts lower silver consumption and we are on collaboration with our customers to optimize fine printing performance and screens matching.

“It should be noted that silver consumption optimization must be related to module reliability/durability. A rational and scientific thinking told us that module reliability cannot be harmed to meet short-term demands. It should also be stressed that the rapidly emerging new cell and module technologies are quickly being adopted in massive production, posing a huge challenge to IEC reliability standards. The establishment of new reliability standards is imminent,” says Dr. Shi.

The China 531 Policy and PV policies released this year have introduced the grid parity period for PV industry. The criteria for “Top Runner” projects have been weakened and such concepts are less frequently mentioned. Product logic during this period will differ greatly from that of the “Top Runner”. In the age of grid parity, cost-efficiency, quality and reliability will weigh more than frequent technology change.

"As to conductive silver paste, the process windows of printing, firing, contact and soldering, etc., which are critical to throughput and yield will become more and more important in mass production except continuous improvement of cell efficiency. Also, metallization technologies like dual printing with better compatibility, flexibility, cost-performance and matching of the properties of PERC LDSE/TOPCon/HJT will enhance its industry presence. In the future, our strategic moves will be tailored to customer needs and market trends. Cell technology has been shifting from poly to mono, raising the bar for conductive silver paste technology, products and applications,” Shi Weili explains.

“Improvements of conductive silver paste for mono PERC LDSE cells will bring about a great difference in performance. Metallization technology is widely recognized as a bottleneck issue for super high-efficiency PV cell technologies, such as TOPCon and HJT. Conductive sliver paste will be more of a technology innovation instead of a common product. Our continuous R&D investments, various technical platforms for conductive sliver paste and more diversified PV product portfolios will give us a head start in this round of market competition."

With the pace of a change as fast as it is, a head start will no doubt be highly advantageous.