Rising economic nationalism in the U.S. and China is dominating news headlines and making waves across the global economy. Less appreciated is the threat it poses to the energy transition.

Already a dim prospect, the odds of keeping global warming to 2 degrees Celsius are getting darker as a result of the deepening trade war, according to Wood Mackenzie Power & Renewables. The consultancy's latest

Rapid and transformational change is in store for the global energy system over the next two decades, particularly in the electricity sector. But with 2 billion people lacking reliable electricity access, and the population still growing, total energy demand will continue rising to at least 2040, WoodMac expects.

Global emissions look set to plateau — though not yet fall — in the 2030s. The ETO stands behind its previous prediction of a peak in oil demand in 2036, despite growth in the electric vehicle market.

Among various factors that could put the brakes on a warming planet, few are as critical as a cooperative relationship between the U.S. and China, said David Brown, Wood Mackenzie’s head of markets and transitions for the Americas.

On that front, however, things have not been going well. At the time the Paris Agreement was negotiated in 2015, there was a feeling of momentum toward global cooperation on climate change.

“There were certainly still hurdles, but everyone had the sense that the two largest emitters would fight through some of those roadblocks, do more on sharing ideas on how to decarbonize, and potentially support investments in lower-carbon fuels,” Brown said in an interview.

“The cooperation sentiment has really eased off as a result of the trade war," he added, with the U.S. and China now "deprioritizing decarbonization" at the strategic level.

A taxing war

For the energy transition, the risk from the trade war comes on several fronts.

First is the negative impact on global economic growth, which in turn makes it more difficult for political leaders to push aggressive decarbonization agendas.

Despite a booming stock market, the U.S. Federal Reserve this week lowered interest rates for the first time since the Great Recession. China’s economic growth has slowed to a multi-decade low, and both countries increasingly appear to be digging in for a protracted trade war.

“The major priority in China is continued economic growth and stability,” Brown said. “If the trade war continues, and it drags on economic growth, it could impact their decision making.”

Meanwhile, the rise of protectionism, exemplified by the Trump administration’s “America First” approach to foreign policy, is making lower-carbon options more difficult or expensive for some countries.

On the renewables front, the U.S. has imposed tariffs on most types of imported solar modules, and newly proposed tariffs on wind turbine towers could undermine project economics just as the wind market enters what is expected to be a historic boom period. By the end of 2019, WoodMac expects the overall U.S. tariff rate to be near 4 percent, a level not seen since the mid-1980s.

Meanwhile, China is showing less interest in buying U.S. liquefied natural gas exports to meet demand in its power-hungry eastern provinces on a lower-carbon basis.

“China is one of the world’s largest hydrocarbon producers,” Brown said. “It has some of the world’s largest supplies of coal. They have that supply option — to switch back to coal — should they want to. Things that could spur that include less bilateral trade with other markets or weaker economic growth.”

While it’s unlikely China would reverse direction on coal, “what’s maybe more realistic is China slows down its coal-to-gas switching,” Brown said.

The impact of protectionism on decarbonization reverberates far beyond the energy industry. Take steel production, which is intensely competitive, inherently difficult to decarbonize, and has “national champions” in many countries. Steel accounts for 9 percent of global emissions.

“Who will be willing to create ‘green steel’ first when the returns are not visible?” the ETO asks.

Among Wood Mackenzie's predictions:

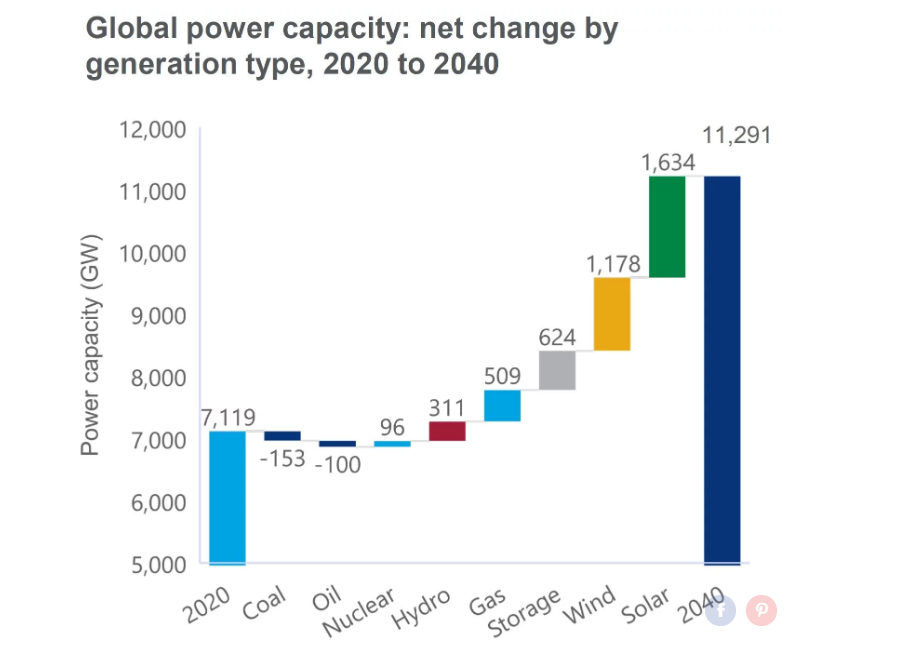

Wind and solar will account for a quarter of the world’s power supply by 2040, up from 7 percent today, and the share will be closer to 50 percent in many affluent countries. The world will add 3,000 gigawatts of wind and solar over the next two decades, six times more than new gas-fired capacity.

Solar energy will be the world’s fastest-growing power-generation technology for decades to come, and the market will rapidly diversify into new countries. WoodMac believes utility-scale solar will be cheaper than gas-fired power just about everywhere by 2023 on a levelized-cost basis.

Sales of off-grid home solar energy systems will notch an 80 percent compound annual growth rate during the 2017-2022 period, bringing zero-carbon power to hundreds of millions more people in places like sub-Saharan Africa.

The global wind market will grow from 44 gigawatts in 2018 to 63 gigawatts in 2028, despite a mid-decade slowdown as subsidies fade away in key markets like the U.S. Offshore wind will grow from 16 percent of the total wind market this year to 30 percent by 2028.

Installed energy storage capacity will grow from 4 gigawatts currently to 600 gigawatts by 2040.

The report also highlights the reasons why keeping global warming to 2 degrees will be so difficult. Decarbonization is moving slowly outside the power sector, with "little to no progress" made in carbon-heavy industries like aviation, shipping, housing and agriculture.

Coal's share of the world's electricity output peaked at 41 percent in 2014, but amid persistent demand in places like India it will still stand at 25 percent in 2040, Wood Mackenzie predicts.

Put together, coal, gas and oil will account for 85 percent of the world's primary energy supply in 2040, down only modestly from 90 percent today.

Later this year, WoodMac will update its alternative energy outlook for a "carbon-constrained" future, which looks at what it would mean to hold global warming to 2.5 degrees Celsius.

Is there money to be made in the energy transition?

Another factor that could speed the energy transition is an embrace of low-carbon technologies by the world's most sophisticated hydrocarbon companies. Aside from a few European players, however, there is little evidence of that happening in a meaningful way.

The ETO delves into the obvious problem: There's not as much money to be made in renewables as in oil and gas, at least not right now.

The difference in returns on investment into various types of energy projects tracked by Wood Mackenzie is striking — running from around 5 percent for solar projects up to 30 percent or more for North American onshore oil.

The reality, WoodMac's Brown noted, is that building and operating wind and solar farms is quite different than the oil business — “totally different assets with different monetization strategies.”

“The market is kind of forcing them together, in the sense that some investors are asking oil and gas companies about their low-carbon business strategies.”

"But it’s a real challenge because the core obligation for these companies is to their shareholders," Brown said. "They want robust and healthy returns, and those come from oil and gas right now."