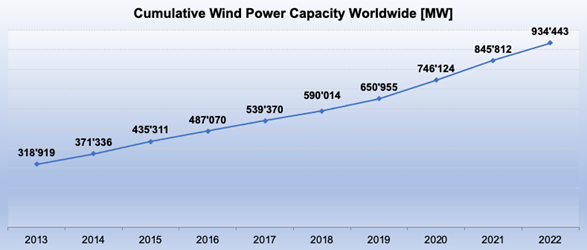

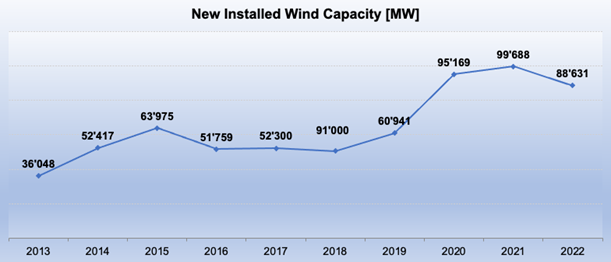

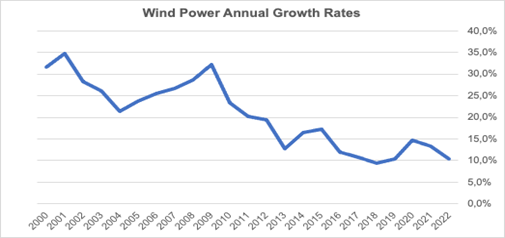

Delays across the globe result in the lowest growth since 2019. 88,6 Gigawatt of additional capacity added in 2022, equaling a growth rate of 10,5%, after 13,4% in 2021. Global wind power capacity stands at 934 Gigawatt – 1000 Gigawatt expected to be exceeded in 2023.

With few exemptions, almost all of the markets have not achieved their projections for the year 2022. The reasons are challenges in the wind turbine supply chains and still unfavourable policies. These are the main findings of the preliminary statistics published today by the World Wind Energy Association.

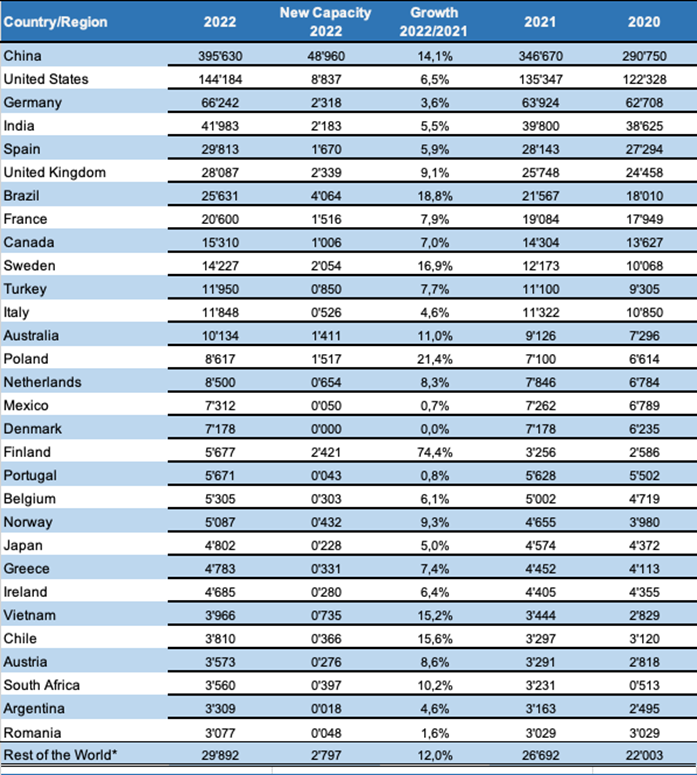

Top Five Markets

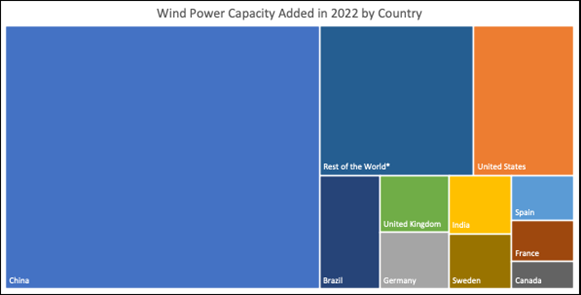

China, as the world market number one, saw strong growth although substantially less than in 2021. A weak wind power year can also be observed in remaining of the top five wind markets, in the USA, Germany, India and Spain. In contrast,

Brazil has shown excellent performance with 4 GW of new capacity, making it clearly the third largest market for new wind turbines. In the foreseeable future, the country will become one of the five largest wind power markets.

Americas

The American continent saw rather weak developments aside from the USA (8,8 GW new capacity), with Canada adding one 1 GW, while Brazil has become the undisputed lead market in South America.

Africa

Wind power plays still only a marginal role in most African countries although major wind farms can today be found half a dozen African countries. Major investment in new turbines happened in the leading wind power country, South Africa, which added 0,4 GW amid a serious power crisis, as well as in Morocco.

Asia

In Asia, China continues to play a role on its own with 49 Gigawatt of new capacity added, substantially less than in 2021 and also below the expectations which experts raised during 2022. However, the country still represents 55% of the market volume for new turbines and 42% of the global wind power capacity. Stronger growth is expected in 2023.

India added 2,2 Gigawatt, which brings the total capacity well above 40 GW. In order to meet the government’s targets, the country will need to accelerate its deployment rates substantially and adjust regulatory frameworks – such step has just been announced.

Some Asian countries including Vietnam and Pakistan saw robust growth rates, while Japan and South Korea underperformed in 2022.

Europe

Europe has a new leader in terms of new installations: Finland added 2,4 GW in 2022, followed by the United Kingdom and Germany which have shown very similar growth, each adding 2,3 GW. Sweden added 2 GW, Spain 1,7 GW, followed by France and Poland, which both installed 1,5 GW.

Growth rates

The growth rate of the global wind sector has reached 10,5%, one of the lowest rates ever since modern wind power utilisation started 40 years ago. The most dynamic markets with the biggest growth rates of the year 2022 where Finland with 74%, Poland with 21%, Brazil with 19% and Sweden with 17%.

The biggest progress in the global ranking of all countries can be found in Finland which jumped from 25th to 18th position, and Poland which climbed from 17 to 14. Turkey improved by one place and took over the 11th position from Italy.

Stefan Gsänger, WWEA Secretary General:

“The wind power market performance in 2022 is disappointing for us. With more than two years of covid recovery programs and six years after the Paris climate accord, we were slightly confident that the wind power industry has the basis for steady growth – although we noticed serious policy gaps. The war against Ukraine which led to huge energy market turbulences added more momentum to improve the investment frameworks for wind energy.

Unfortunately, as the results show us, the frameworks are not yet sufficient to allow the wind power sector to invest on the required scale. We call therefore on governments to improve policies for wind power. The wind sector needs stable and predictable remuneration schemes as well as smoother and faster permitting processes. Regulatory frameworks must also cater for strong engagement of local citizens and communities and support benefit sharing in order to strengthen the social support for wind power.”